Annual profit across the non-bank lending sector sank for a second consecutive year, KPMG's annual Financial Institutions Performance Survey (FIPS) for specialist lenders shows, as funding costs again surged.

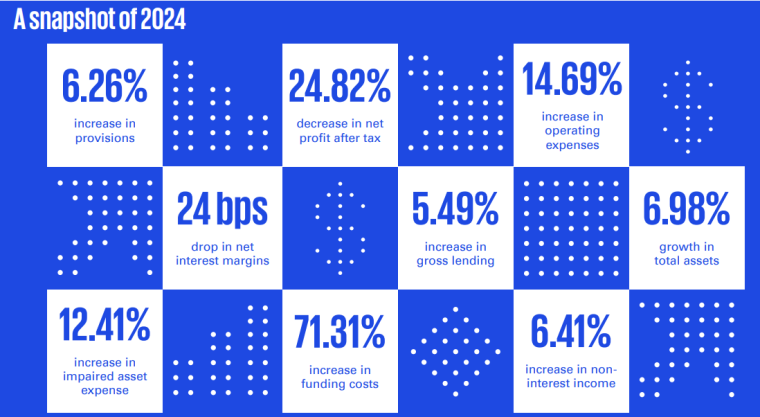

Hot on the heels of a 27% fall in net profit after tax for the sector last year as funding costs jumped 93%, profit this year dropped $80.2 million, or 25%, to $243 million. Funding costs, driven by increases in interest expense, surged $362 million, or 71%, to $869 million this year, KPMG says.

"The observable decrease in net profit after tax is largely attributable to the increased cost of funding seen across the specialist lenders sector, with 18 of the 26 participants experiencing a decrease in net profit after tax," KPMG says.

"Although interest income across the sector grew $408.7 million, or 25.7%, this was largely offset by increased interest expense of $361.79 million, 71.31%. Increases to operating expenses and impairment expenses drove the remainder of the decrease in sector net profit after tax, with increases of $154.48 million, [or] 14.69%, and $17.27 million, [or] 12.41%, respectively."

Leveling of playing field sought

The FIPS delves into a key bugbear of the non-bank sector, which is the Reserve Bank's Exchange Settlement Account System (ESAS).

"Capital deployment within the finance sector is not necessarily occurring on a level playing field basis, and our specialist lender survey participants are among those feeling the impact. There are growing concerns about the inequity stemming from specialist lending entities' absence of an Exchange Settlement Account System (ESAS lite) or similar account," KPMG says.

The ESAS is New Zealand’s wholesale real-time gross settlement system for payments used for processing and settling payments between banks and other financial institutions. It's owned and operated by the Reserve Bank. Settlement cash in ESAS is remunerated at the Official Cash Rate (OCR).

Those with ESAS accounts include ANZ, ASB, ASX, BNZ, Bank of China, China Construction Bank, Citibank, HSBC, ICBC, Kiwibank, NZX, the RBNZ, TSB, CLS (Continuous Linked Settlement), the Local Government Funding Agency, Treasury's Debt Management Office, the NZ Super Fund, Rabobank and Westpac. However, other entities - including non-bank deposit takers (NBDTs), payment service providers and fintechs - would like ESAS accounts and the Reserve Bank is reviewing its ESAS access eligibility criteria.

"This situation means that when specialist lenders place excess funds they, compared to a bank with an ESAS account, get a lower return and have to hold additional capital. In most cases these placements are with banks who receive the benefit of a higher rate and lower capital. Although regulatory obligations are generally deemed acceptable, consideration could be given to adjusting them to match the size of the institution," KPMG says.

"While these existing standards may be appropriate for larger banks, NBDTs struggle with not accessing the Reserve Bank's OCR directly and are instead forced to borrow from banks at a higher cost. This situation increases costs and capital requirements for NBDTs."

"Banks are in a favourable position, able to place funds at the OCR with the Reserve Bank with minimal risk. This situation highlights the overall fairness issues within the current system, as specialist lenders are excluded from participating directly, perpetuating the imbalance in capital deployment across the sector. Additionally, when specialist lenders place deposits with banks, they are required to maintain 20% capital due to these placed funds," says KPMG.

"The specialist lending sector in New Zealand contributes to approximately 8% of the lending market. In comparison, countries like Australia have a specialist lending sector that represents between 15% and 30% of the market, while in the USA, it is approximately 50%. For the specialist lending sector in New Zealand to truly thrive and achieve market growth, the imbalances in lending ability and funding must be addressed to create equal opportunities for both the banking and specialist lending sectors."

The Commerce Commission's final report in its market study for competition in personal banking services recommended the Reserve Bank place a greater emphasis on competition in specific upcoming decisions, including the ESAS access review.

Meanwhile, Finance Minister Nicola Willis this week said she has outlined a series of expectations for the Reserve Bank to prioritise including expanding access to the exchange settlement system with decisions by March 2025.

Avanti opts out

The specialist lending FIPS, until last year referred to as the non-bank sector FIPS, captures the financial performance of 26 entities with annual balance dates between 1 October 2023 and 30 September 2024. The threshold for inclusion is based on total assets of $75 million in one of the last two years. The sector has 1.7 million customers and $20 billion of lending. For the FIPS, KPMG interviews chief executive officers and chief financial officers.

Avanti Finance, previously ranked by KPMG as NZ's second biggest non-bank financial institution after UDC Finance with total assets of more than $2.2 billion and 11.15% market share, chose not to participate in the FIPS this year, KPMG says.

"Avanti were always a voluntary participant in the survey providing their audited financial statements that were not otherwise available, for the current year they have elected not to participate," KPMG says.

Overall eight survey participants reported higher profit, led by Wairarapa Building Society with a $2.3 million, or 300%, increase. Next was First Mortgage Trust with a 32.4%, or $29.4 million increase.

"Although the majority of survey participants experienced a decrease in net profit after tax, six participants have reported a loss for their financial reporting periods, an additional three participants compared with the 2023 survey," says KPMG.

"It will be interesting to see how this trend in profitability continues during the following financial year, and whether the specialist lenders sector can bounce back, and remain profitable going forward."

"The answer to that question might well depend on two factors: 1. How they manage the falling interest rate cycle we appear to be in; and 2.Where the New Zealand economy heads and how quickly and how strongly – will the much hoped for growth occur in half-year 2025 or will it be 2026."

Asset growth 7%

Annual growth of total assets across the sector came in at $1.3 billion, or 7%, to $19.35 billion. This was below the previous year's 8% growth, but above the five-year average of 6.5%. Twenty survey participants reported an increase in their total assets, with six experiencing a contraction.

Gross loans and advances (GLA) grew 5.5%, or $819.10 million with 15 survey participants experiencing a loan book increase and 11 a contraction.

"Of the six survey participants reporting a contraction in total assets, Unity Credit Union experienced the largest percentage decrease of 9.19% ($36.82 million), to $364 million in 2024. This was reflected in a drop in GLA of 22.28% ($57.71 million); the largest percentage reduction of all survey participants. John Deere Financial Limited has reported both the largest percentage increase in both total assets and gross loans and advances of 41.64% ($90.73 million) and 41.06% ($86.27 million) respectively. John Deere has also seen the largest percentage increase in market share based on GLA, increasing by 33.72% (47 basis points, or bps) to 1.88%," KPMG says.

Toyota Finance reported the largest dollar value growth in total assets of $333.79 million, followed by UDC Finance with an increase of $326.55 million. This almost entirely stemmed from an increase in GLA of $314.83 million, the biggest dollar value increase in GLA across the sector.

"Nelson Building Society has experienced the largest dollar value reduction in GLA of $71.43 million, which has corresponded to a 77bps reduction in market share to 5.27%. UDC has remained the largest participant in the survey, with its loan book now surpassing $4.50 billion, and market share based on GLA increasing by a further 53bps to 28.82%," KPMG says.

"First Mortgage Trust experienced the largest basis points increase in market share of 63bps, increasing to 8.82%, and is the third largest participant in the survey, with their loan book at $1.39 billion. Latitude has held their position as the second largest with a loan book of $1.40 billion despite incurring a 75bps reduction in market share to 8.89%."

Average NIM drops

Meanwhile, the average net interest margin (NIM) across the sector fell 24bps to 6.33% from 6.57%. Prospa NZ led the way with a 409bps reduction, followed by Latitude and Unity's 186bps and 175bps drops respectively. Vehicle leaser SG Fleet NZ recorded a 329bps increase.

"The impact of the Reserve Bank’s OCR has also played a role in another year of mixed NIM results, with 17 survey participants experiencing a decrease in their NIM. The impact of the OCR changes varied among participants dependent on respective balance dates and hedging strategies," KPMG says.

In terms of interest income, UDC had the biggest dollar value increase of $141 million, or 51%, to $418.5 million, with John Deere delivering the biggest percentage increase of 53%, or $5.7 million, to $16.4 million.

Loan provisions across the sector increased $16.9 million, or 6.3%, to $286.8 million.

"This upwards trend suggests that asset quality for the sector continues to face pressure, resulting in increased provisions and more rigorous monitoring of loan portfolios. However, participants pointed out that much of this provision growth was due to loan book growth and/or the impact of worsening forward looking assumptions in their models and were not necessarily representative of actual losses," KPMG said.

"Impaired asset expenses also saw a rise, increasing 12.41% to $156.35 million, and has resulted in the impaired asset expense to average loans and advances ratio increasing by 6bps to 0.99%. These figures reflect a sector grappling with the challenges of maintaining asset quality amid economic uncertainties, and fluctuating borrower repayment capacities, with 11 survey participants recording an increase."

The biggest dollar value impaired asset expense increase came from Latitude, up $26.4 million to $64.7 million, the largest impaired asset expense recorded by any survey participant. Geneva Finance delivered the biggest percentage rise of 6,624.29%, an increase of $4.6 million to $4.7 million.

Expenses rise

Operating expenses across the sector climbed $154.5 million, or 14.7%, to $1.2 billion.

"This movement is similar to the increase seen in 2023, which represented the increasing costs and inflationary pressures the economy continued to see over the year. The impact of increasing costs and risk in interest rates was seen across the board. This has correlated to the operating efficiency ratio, operating expenses as a proportion of operating income, decreasing by 244bps to 43.78%," KPMG says.

In total 23 of the 26 survey participants reported an increase in operating expenses. Nelson Building Society led the way with a $18.9 million, or 112.3%, increase to $35.7 million. Those reporting a drop included BMW Financial Services, Nissan Financial Services NZ, and Wairarapa Building Society.

*The chart and table below come from the FIPS.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.