Westpac New Zealand's annual profit jumped 16% as income rose and loan impairment charges fell.

The bank's September-year net profit after tax rose $167 million, or 16%, to $1.226 billion from $1.059 billion last year, according to its latest general disclosure statement.

Net operating income rose $194 million, or 7%, to $3.095 billion, with net interest income up $186 million, or 7%, to $2.839 billion.

Operating expenses rose $74 million, or 6%, to $1.365 billion. Loan impairment charges tumbled to $27 million from $135 million.

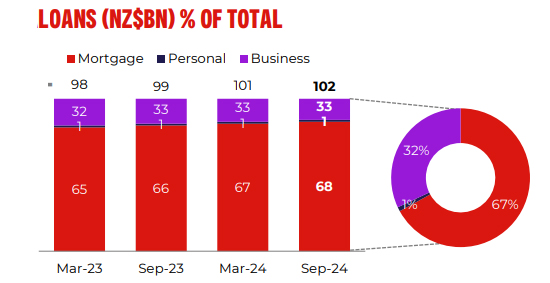

Westpac NZ CEO Catherine McGrath said the bank grew home lending by 3% to $68 billion over the September year, business lending rose 2% to $33.4 billion, with deposits flat at $79.7 billion.

"We estimate by the end of the year that more than a quarter of our fixed home loan customers will have rolled onto lower rates, and nearly three-quarters by this time next year," McGrath says.

"Westpac has acted swiftly to pass falling interest rates on to customers. The bank has cut its advertised 1-year fixed home loan rate by a total of 1.15% p.a. since the start of July, and cut floating rates by a combined 0.75% p.a. in line with Official Cash Rate reductions, with potential interest savings of $58 million for its 60,000 floating home loan customers over the next 12 months."

"Our business and agri customers have also seen rates fall over the same period, which will help farmers and growers save an average of around $13,000 a year each in interest costs," McGrath says.

Peter King, CEO of Australian parent Westpac Group, says NZ mortgage customers are on average 11 months ahead on payments.

McGrath told interest.co.nz over the past two years Westpac NZ had focused on proactively contacting customers facing interest rate increases. Now, with unemployment rising, the focus is on; "making sure that we're supporting customers who may be having a reduced income into the household."

In a falling interest rate environment she says some customers are deciding to "sit on a floating rate for a while simply to see what happens. Or they're doing a really sensible thing of hedging their bets where they're leaving some of it on the floating [rate] and they're putting some of it on a fixed rate."

Net interest margin rises

Westpac NZ says its annual net interest margin, the difference between what the bank borrows money at through the likes of deposits and what it lends it out at, rose four basis points to 2.17%. Its annual cost to income ratio rose 138 basis points to 47.72%.

Westpac NZ paid annual dividends of $657 million, up $5 million year-on-year.

As of September 30, Westpac NZ had total capital of $11.335 billion versus its minimum requirement of $6.317 billion.

Figures released in Westpac Group's results show Westpac NZ's mortgages 90+ days past due rose to 0.49% of its total portfolio from 0.33% at September 30 last year.

McGrath says; "we have strong momentum and are heading into 2025 energised about helping Kiwi households, businesses and the economy to grow."

Meanwhile, Westpac Group posted a 3% drop in annual profit to A$6.990 billion. It's annual net interest margin dropped two basis points to 1.93%, and its return on equity fell to 9.77% from 10.09%. It's paying out 73% of profit in dividends. Westpac Group's common equity tier one capital ratio stood at 12.49% at September 30, up from 12.38% a year earlier. Its total stressed loan exposure as a percentage of total committed exposure rose to 1.45% from 1.26% year-on-year.

Westpac NZ's press release is here.

20 Comments

progressive business tax rates -- say add 3% at 10 million --- 5% at 50 million and 10% at 100 million + further increments at thee ridiculous levels!

Another 1.2 billion out of working Kiwis pockets to corporate Aussie -- time to stop this rort

Be a VERY VERY popular tax in NZ across the whole political spectrum ---

$1.2b out of working Kiwis pockets? How many staff does Westpac NZ employ? At last check ~5,000.

Not all $1.2b is paid as a dividend to the Australian parent. $657m of total dividends was paid, and how much of this was to NZ based investors?

Not all $1.2b is paid as a dividend to the Australian parent. $657m of total dividends was paid, and how much of this was to NZ based investors?

As for the parent company, Westpac has a notable portion of its ownership outside Australia, with international investors holding around a quarter of the bank's shares. Institutional investors hold about 53.1% of the total shares, while retail investors account for approximately 46.9%.

https://www.westpac.com.au/about-westpac/investor-centre/westpac-share-…

I agree. People get too fixated about the banks being “Aussie”. If you have KiwiSaver or other investment fund savings most will own not only a piece of those banks, but a piece of companies all over the world. Do they feel bad about taking money out of the pockets of citizens in just about every other developed market in the world?

People want the spoils of the Ponzi but not the trade-offs. Go figure.

and they will still employ 5000 staff -- although the banks have been cutting staff and branches for years now and would no doubt continue -- and yes not all of it goes overseas -- but a huge chunk does -- and yes some to large kiwi investors and share holders -- but thats jut wealth transfer up the line ... again

1.2 billion is obscene amount of pure profit -- when so many New Zealanders are simply trying to food on the table, a roof over their head

He may be correct. It is after tax profit, which means operating expenses, like the salaries of those 5000 NZ employees, have already been deducted prior to calculating any taxes.

While it's true that a fair number of those employees probably have shares, so would benefit some-what, dividend payments to Westpac corporations in NZ probably still end up overseas, as the holding company is Westpac Banking Corporation, which is registered as an Overseas ASIC Company.

Progressive business taxes could simply encourage splitting of business units into separate legal entities for tax purposes though?

That would be seen for exactly what it is.

Sensible?

Unless legislated against to be able to occur, and more importantly, adequately enforced.

Tough old year for the NZ banks alright...

If I was a betting man I’d say this won’t make the news. They stopped have it a finance/business segment many moons ago.

I am not a conspiracy theorist but boy does the news get dumbed down. We don’t want there to be an uprising now do we!

RNZ, NZH, NBR and Waikato Times have all reported it, or do you mean TV news?

Yes, One News at 6pm

That's not news.

To put some numbers on how badly New Zealanders are being looted by the Australian-owned banks, the Westpac Australia result shows net interest margin falling across the Tasman, to 1.96%, and cash profit down 3%. And Australia isn't even in a recession.

Here, despite two years of recession and the number of people on a benefit set to cross 400,000 before Christmas, Westpac NZ increased its net interest margin from 2.14% to 2.17% and its net profit by 10%. We are being price gouged at every turn.

New Zealand has become the cash cow for the Australian banks.

Trebles all round!!!

Am I the only one who is irritated by that loan chart? The bars are completely out of proportion to their values. Are they trying to enforce a narrative or just crap at drawing?

Westpac has nearly 80 billion in deposits. That's a lot of people accepting poor returns who need to move their cash and make the bank sit up and take notice. I moved all investment funds out of Westpac to people who have slightly more focus on customers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.