New Zealand's largest economic sector - residential real estate - had a banner year in 2021. Our extension of the RBNZ M10 series suggests the value of all housing in the country could have reached $1.675 tln by the end of 2021, or 4.8 times larger than our annual economic activity as measured by GDP. (In 2020 it was 4.3x, in 2019 it was 3.7x.)

Housing's domination is increasing.

For more than a decade since the availability of the data starting in 1990, housing was valued at about 2x annual economic activity. It got its first spurt higher as a consequence of the Clark/Cullen 39% top tax rate, then settling in to about 3x GDP. A new frenzy started about a decade later which took it to about 4x GDP. And now we look to be in yet another push higher, pushing on towards 5x annual economic activity. Another 39% tax rate is now in place, and the shelter real estate gains provide is clearly attractive.

And the funding of all this and its growth didn't miss a beat during all the pandemic hurdles of the past year, even the past two years.

Over the past year, this mortgage debt owed to banks has grown by +10.7%. In 2020, that growth was +8.2%. In 2019 it was +6.9%. Momentum built in 2021. Prices rose at a faster rate, +24% in 2021 vs +19% in 2020 and +12% in 2019. Further, house-selling transaction volumes are increasing - the churn - and were +9.4% higher in 2021, compared with +6.4% in 2020 and actually a -1% decrease in 2019.

The concentration of the New Zealand economy around a single sector has intensified. We collectively owe 93.1% of all annual economic activity to banks in the form of mortgages; 94.5% if you include the housing debt owed to non-bank lenders.

The official responses to the pandemic emergency drove down interest rates. There was a monetary response from the RBNZ, but it did have a remarkable fiscal benefit. Governments borrowed and spent to hold back the inevitable pressures on the jobs market. Fewer jobs were lost in this pandemic recession than any other recession, ever. In fact, that policy of protecting employment has allowed income tax revenues to stay healthy through a difficult time. The certainty of employment in turn bolstered the housing market.

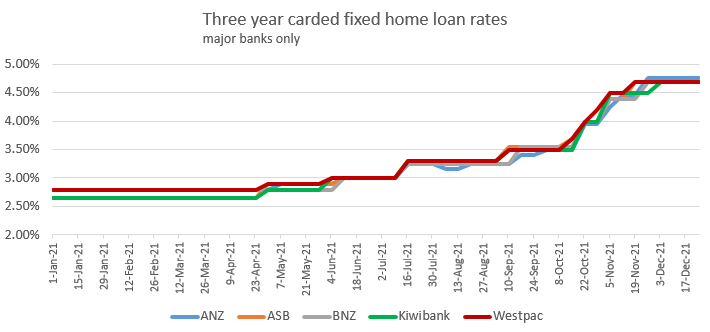

Mortgage interest rates started 2021 low, and went down from there, reaching their lowest point ever in July 2021.

But then, the RBNZ started signaling that it was now time to normalise these emergency rates. The verbal signals resulted in an OCR rise of October 6 and another on November 24, taking the 0.25% OCR up to 0.75% by year's end.

More rises, possibly more than +1.5%, are on their way in 2022 and 2023. Much will depend on the health of the labour markets, but they are in good shape now at a time inflation threats are rising. An early 2022 +50 bps OCR jump has to be possible, if only tp signal that containing inflation remains a core policy goal.

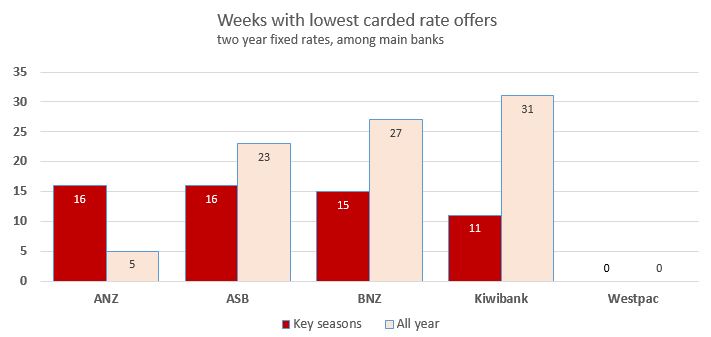

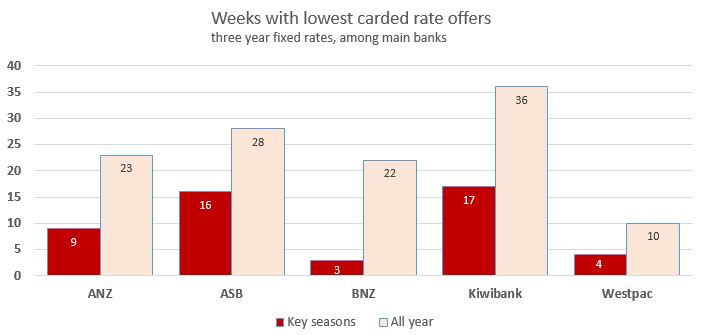

In 2021, among the main banks, the most aggressive rate setter (the bank with the lowest rates) has been ASB. They had the overall lowest carded rate offers for the fixed one, two and three year terms for 28 of 52 weeks. They were closely matched by BNZ and Kiwibank who managed that for 27 weeks. ANZ managed it for 23 weeks, while Westpac was consistently the least rate-competitive, having the lowest rate for just 12 weeks in 2021.

Here are the tracks for each rate term.

If we just focus in on what are the two traditional core real estate selling 'seasons' which are also when most of the fixed rate contracts roll over - late January until Easter, and mid September until early December - then the positions are a little different. ANZ had the most weeks with the lowest carded rates, 17, closely followed by ASB at 16. BNZ was lowest for 11 weeks, Kiwibank for 10 weeks and Westpac for only six of these 27 high-impact weeks.

Here are how the advantages for each term stack up:

Of course, most challenger banks operate with rate cards below main bank levels, and through much of 2021 Heartland Bank's offers were the most competitive of any bank.

We are in an historically usual situation where our policy rates are higher than those for both the US and Australia. That will no doubt be the case for the foreseeable future, but the magnitude of the difference might swell, especially compared with Australia as they seem to be in no hurry to normalise.

67 Comments

What will the impact of the CCFA and the significant reduction in volume lending by the banks be on rates by March/April?

If banks won’t/can’t lend then the rates will need to drop. BNZ & others are now offering a special 2.99% rates unadvertised apparently to new borrowers to re-attract business.

Other way round, if they can't increase volumes, they'll have to increase margin to keep head office happy.

It just shows you how loose the lending has been. How did we learn nothing from the GFC? How has the Reserve Bank, who's main purpose is to stop this type of thing not been shut down until a thorough investigation ensues. The Reserve Bank looks to be working completely against New Zealands interests, Orr must go.

I think people and companies have indeed learned from the GFC, the lesson is simple; If you're financially careless, if you take on too much debt, don't worry the Government and the Central Bank will save you. Hence many have indeed taken on lots more debt over the last few years and been even more careless and… they have been rewarded. I'm not saying this is right but it's hard to argue it's not true. For those who like to lay the blame, I suggest that blame lays with the rule makers, not with the people or companies who have played by the new rules.

A cynics view perhaps, yes the rb controls interest rates as a lever to smooth the rough economic waves. Certainly not the first consideration for us.. when we took on risky debt in the 90s and later, we never for a moment thought the govt or rb would be there to bail us out. We believed then and still do that it was personal responsibility and sacrifice that would make the difference. I just watched a doco on captain cook... being away from home for 3 years at a time on a bouncy and unpredictable sea he knew he had to be extremely self reliant.

You talk about the 90's and Captain Cook, without meaning disrespect, we need to adapt to the ever changing rules or we're left behind.

Tbf it's, according to some of us, even deeper than that. The Christchurch earthquake response along with the bail out of finance company depositors amongst other things took away risk in a number of areas, so long as you are part of a sizeable number and have the ear of the right people.

For those who like to lay the blame, I suggest that blame lays with the rule makers, not with the people or companies who have played by the new rules.

What about personal responsibility?

That's my point Al, the government is increasingly cocooning everyone, trying to protect all without realising the cost to everyone else.

I far prefer personal responsibility and increased freedom.

Personal responsibility mainly comes from understanding the consequences of your actions. Since borrowing to invest in property seems to have few negative consequences, it is not being considered immoral to take advantage of the situation we find ourselves in. if the current trend of FHBs being priced out of the market doesnt bother you, you're probably an investor. or in Government. it's human nature to take the path of least resistance, and to get the most for as little effort as possible, so I'm not at all surprised that people who have the means will leverage the measures the RB put into place.

The ONLY way to stop this is for the rules to change.

Make the consequences for investing in residential real estate so distasteful that investors put their money into NZ businesses instead.

New Zealand is a case study in economic mismanagement.

Agreed. When the PM stated that house price increases were expected, I knew we were in trouble.

Hard to see how home borrowers paying $200-300 more per month on their mortgages is going to constrain external supply-side inflation in petrol prices, building supplies hikes, and food prices etc. Or maybe the RB now has house prices in its CPI basket?

House prices have always been in the CPI, it's land prices that got taken out in the 90s

Only new builds. Not existing houses.

https://fyi.org.nz/request/14885-housing-costs-within-the-consumer-pric…

Housing costs are not house prices. Big difference.

Well, with CCCFA the govt has shown some backbone to tackle the housing ponzii. Its all about Responsible Lending. So what's wrong with that?? Unhappy will be whose business & livelihood depended on enabling borrowers to load up to the hilt with unaffordable debt. Irresponsible lending, otherwise why so worked up against CCCFA ????. Sudden burst of charity & altruism amongst vested interests , appearing to show concern for borrowers!!! All sorts of petty, trivial reasons to oppose CCCFA. Simple solution. If not happy to practice responsible lending , shape up or ship out. Go look for another job or business. Hope the govt stands firm and not cave in to self-interested individuals & businesses.

So you won’t be signing the petition then? Lol.

https://www.mpamag.com/nz/news/general/squirrel-launches-petition-calli…

Non-bank lenders are now seeing a boon to business. So consumers effectively pay more.

Why are non bank lenders not included in CCCFA? Wasn't this legislation initially for loan sharks...

That angle must have escaped the legislators. Incompetent or corrupt take your pick

They are included, but perhaps not quite as strict or conservative as the banks in execution. Also are not covered by the LVR restrictions.

Petition no. Perfer society avoids being tricked into a lifetime of debt enslavement.

Re alternative lenders. They are always there, but at higher margins reflecting the higher risk. Low profile since the GFC, which killed most of them.

Squirrel...#vested interest. All the things the petition cites as issues were historically prudent lending practice. The text simply serves to highlight how bad the banks have been and the bubble nature of NZ property debt.

You should really stop with the "lifetime of debt enslavement" rubbish. You can't expect to live in a house for free can you? So you have 2 options:

1) pay rent for a lifetime and have nothing to show for it...ever

2) pay a mortgage for 25-30 years and have a paid off house worth $1 Million or more

I know which I prefer

Yawn. Already done option 2 several times. It's the next generation Im concerned about. Clearly you think 10-12x earnings is better for them than 4-5x earnings.

If you've paid off several mortgages then you'd know that it's not just the multiple based on the purchase price that matters but also what money costs you.

Agreed. It's what you can earn where the massive disconnect is. Central banks have protected themselves by tanking rates (cost of debt) and printing to avoid the inevitable reset. This is the great fraud of our generation with inflation arriving in spades. Twenty doller coffee and 200k minimum wage anyone?

Bankers profits and printed speculation only rewards and promotes the risk taker with no recourse for risk. It kills any balance in the normal economy as inflation rips the balance appart.

Twenty doller coffee and 200k minimum wage anyone?

The $200k min wage is not going to happen. In fact, income increases are not even matching inflation (not CPI, but expansion of money supply, which is reflected in bank lending + increase in cost of goods and services).

Central Govt not central bank.... GR had treasury issue bonds to rbnz at zero percent. All paper money with little accountability, 50 billion dollars wasted so that the kiwi paupers could live like kings for a year. Only now are ardern and the other incompetents talking health upgrades... after LUXON was on their case

How do you come the conclusion that non-bank lenders are seeing a boon to business?

It seems unlikely, when Squirrel, a non-bank lender, is petitioning the government to change the CCCFA laws in the article you linked. Why would they do that if their business was booming?

Squirrel are primarily mortgage brokers, go figure why they're upset...-$$$

Let's keep the interest rate low forever..

Let's see how crazy the housing market can go. Why worry about anything.

Housing economy is more than five time....think it is not five time but ONLY Economy in NZ.

At least in 2022, we should tell truth as it is

Except that's not really the case. Many sectors of our economy currently have more business than they know what to do with.

It's just sexier to talk about housing, and more relevant to people. And actual businesses kinda suck to own and run.

All those masters of industry, with large brains, putting in so much sweat to start a company, working 120 hour weeks, having no holidays, paying massive taxes, employing people, enormous responsibility, enormous strain on the family, just to scrape by, when all they had to do was sit on their backsides playing playstation and buy a couple rentals in the luxurious Porirua or Palmerston North and they would have been much wealthier, happier and their life expectancy will be greatly increased. No more stress ever, just pass all that on to the mug renters. What is the point in trying in NZ when a certain section of society is always promoted and protected? Orr and Robertson need to be held to account.

Not that many people my age (now in 50s) that were interested in buying rentals, no one in my circle of friends other than the guys at the PIA... and for various reasons only *some* of my close friends even wanted to buy a house for themselves. Similar to three/four years ago 2017, 2018 and 2019 when houses were cheap but there was always an excuse not to buy. Look up some of the comments. When we bought rentals it was for genuine investment of making a cashflow servicing the debt, and paying off the house over the longterm. Always the wolf at the door, tenant troubles and vacancies, councils that see property owners as a cash cow, unforeseen expenses, interest rates going up and up. Nothing has changed. As for buying in Porirua.... well

In the mid nineties, When I told an in-law we had bought a rental there was a swift reaction of howls of laughter followed by mocking how the tenants would destroy it. Within ten years she had done an about face and was asking my advice to buy a rental house.

I had a business. I've had many businesses.

The last one was... the last one. After slogging it out getting it going, rebranding, massive sales campaign, build book new clients, errant staff, more compliance.... I eventually thought screw this, sold it in 2018 and just bought property. Best decision ever.

I know a guy who recently walked away from selling a business he and some friends co-founded about 10 years ago. His share of the sale amounts to around $4 million (before tax) so a great sum of money.

However, he has worked 60+ hour weeks every week for the last decade, missed out on holidays and social events, lived off fumes for several years (after having walked away from a well-paid job) and looks like he has aged about 30 years from all the stress.

He worked out that had he just kept his job and instead invested in property, he would have made more money for a whole lot less stress.

Ok, he wouldn't have provided jobs to about 50 different people, or built a great company up that is going from strength to strength ... but at the same time how frustrating must it be?

Mentioned before but fits well with a young perspective. Five kids, 4 own houses, one bought business. Business is good but they find it really depressing just how much they lose out and even get stung with CGT via stock values.

He should have worked smarter, not harder. I know businessmen who hardly work at all.

Also, investing in property is not stress free.

It seems every other dairy/superette has an owner who owns multiple shops. Obviously they cant run every shop themselves. Some shopkeepers I have met, not only own the one shop they work in but they have another shop or two as well as a property or two. When you look at them you would think they are poor :)

Unless they fell into money, any businessperson who hardly works at some point did some serious Mahi.

Housing economy is more than five time....think it is not five time but ONLY Economy in NZ.

Yes. I recently quoted it as 4x. I missed a whole recent year of GDP.

If u really think that housing is the one and ONLY, then change it by growing and broadening the economy. . Anyway we also have beneficiaries as an economic sector apparently, and we are told by paying them more free cash we are growing the economy. Yippee

Remember NZ is godzone... or is that twilight zone

We track which banks had the lowest home loan carded rate offers through 2021 and saw how low rates juiced up a housing market where values now threaten to exceed five times our annual economic activity

..it can be plainly seen today that the most important macroeconomic variable cannot be the price of money. Instead, it is its quantity. Is the quantity of money rationed by the demand or supply side? Asked differently, what is larger – the demand for money or its supply? Since money – and this includes bank money – is so useful, there is always some demand for it by someone. As a result, the short side is always the supply of money and credit. Banks ration credit even at the best of times in order to ensure that borrowers with sensible investment projects stay among the loan applicants – if rates are raised to equilibrate demand and supply, the resulting interest rate would be so high that only speculative projects would remain and banks’ loan portfolios would be too risky. - Link - section II-3

Falling interest rates result in lower discount rates applied to derive the present values of perceived cash flows associated with residential property investment. Speculators seek to capitalise the rising present value of the asset cash flows with leveraged bank loans.

But - “Ultimately there’s no natural income streams to be able to service and repay loans. What you have is capital gains which are contingent on the game continuing. So it’s a Ponzi scheme". says Werner.

A peek over the financial horizon for what's in store for NZ:

Japan pays a high price as it goes down market

The world’s third richest country is facing rising poverty – and its associated ills

Japan is cheap. Yes, you read that right. This may surprise – or astonish – those familiar with the country’s high value-added brands, its “bubble era” or Japanese land prices – touted as among the most expensive in the world.

It certainly flies in the face of conventional wisdom. But decades of stagnant wages, deflation and the gut-punch left by Abenomics have left Japan the Daiso of the world.

Examples? Out of 141 countries, Japan has the fourth-lowest starting salary. It has the lowest entry price for Disneyland. And Big Mac prices in Japan are on par with those of an emerging economy.

And Japan is still a net creditor nation (it lives within its means) compared to the drunken sailor debtor nation of NZ.

A Minsky bubble.

CCCFA puts a focus on safer lending practice that the banks should be doing. The goal is to prevent a tax payer bailout after the Banks years of super profits and speculator tax free gains.

This combined with declining tax rinse on rental debt is causing some stress. Newsflash everyone has been overpaying for rot boxes, that prudent CCCFA models highlight are now way overpriced or not supported by income...aka speculative debt. Alternatively you could use real equity vs a stacked escalator of debt ...hahaha that was funny.

Speculator tax avoiders...so sorry the game is up. FHB'ers, stop your wailing. The CCCFA is about to save you years of mortgage repayment.

FHBs haven’t got a hope of buying a home now. And a credit crunch due to an overreaction to the CCCFA by banks is going to hurt small business owners.

Agreed but surely you would perfer they dont get caught underwater when the inevitable pop happens?

Sure, but as long as FHBs can service their loan then a brief period of being underwater is a risk that they may prefer to manage - rather than the risk of saving slower than prices climbing. The CCCFA was good in intent, but has now unleashed unintended consequences that may escalate beyond slowing down house purchasing.

Many people think the housing market is a bubble but what if its not ? What if even more is poured into it in 2022 ?

Average wage earners cannot afford to buy in Auckland so even if interest rate stay low who will buy, inflation is starting to cause problems with people not being able to put a roof over family’s head and buy food. This market is at the top and once people see this a huge correction will happen.

I guess if average wage earners earn 70k, someone who who earns a million a year can outcompete them for 20 years and the average wage earner still won't catch up.

Money is just a marker, so if you're average, and living in a continually growing city, you're going to struggle competing for accommodation with an increasing amount of people who are wealthier than average.

Auckland is not a place to live if you're working class.

So this is the new Normal? The most expensive place to buy property in the developed world? In Auckland only people with property already in the family able to get into the game?

History says that capital assets inflated by debt are usually bubbles. And usually correct at some point.

But sure could be the new normal. Let's just keep printing money, inflation hasn't kicked in till just recently. How bad can it get?

*checks supermarket receipt... Cries*

But sure could be the new normal. Let's just keep printing money, inflation hasn't kicked in till just recently. How bad can it get?

From memory, I think Orr said that house prices could fall 60% and the banking sector would still be OK. No idea how they model this. And of course they don't explain it to the hoi polloi. We're too stupid to understand. Only smart people like Robbo, RBNZ employees, and commercial bankers can understand.

There has been a substantial acceleration in inflation in the second half of 2021, RBNZ has now over-juiced the economy so monetary (and fiscal) support will need to be wound in.

However generally with the switch from Delta to far milder Omicron the pandemic will be increasingly in the rearview mirror outside of the hermit kingdom.

I am hearing rumours that the govt. will make it easier for first home buyers to get loans

Dunno how

State Advances Corporation loans of 3% for the life of the mortgage?

Hmmm. Allow Fhb'ers to qualify while avoiding badly overdue reset. Would that mean the tax payer then underwrites these loans?

You do know that this government or even the next wants this party to continue, right ? Nobody wants a crash on their watch or they will be booted out next election.

You do know that this government or even the next wants this party to continue, right ? Nobody wants a crash on their watch or they will be booted out next election

Of course, but you have to think of the trade offs. If you pour all the country's resources into trying to safeguard the bubble, you have to live with the consequences (of which they don't really know or are prepared for). Furthermore, the NZ govt and RBNZ aren't as omnipotent as the sheeple are being led to believe they are. External factors (particularly known unknowns and unknown unknowns) make the situation more precarious.

While we push a lot of milk etc let's not pretend that the Govt and RBNZ set finance strategy in NZ. Global finance directs traffic. We are a dot on the global ocean.

Well they do control the money supply and regulate the banks.

Like student loan or interest free deposit for x years.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.