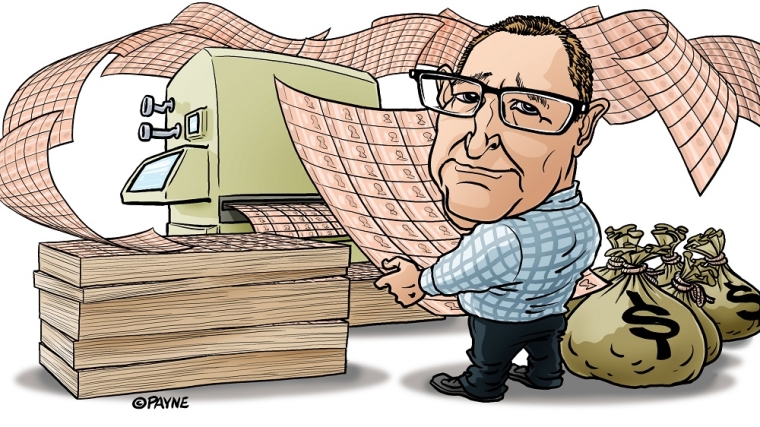

It has been revealed Treasury advised Finance Minister Grant Robertson to suggest the Reserve Bank (RBNZ) attaches conditions to its $28 billion Funding for Lending Programme (FLP) to direct newly-created money to productive parts of the economy.

Robertson on Thursday confirmed he had “discussions” with the RBNZ over putting conditions on the FLP, but noted the FLP’s design ultimately rested with the RBNZ.

The RBNZ in December started offering banks cheap loans to help them lower their interest rates to stimulate the economy. While these loans are secured, banks can do what they want with the funding.

Robertson in late-August publicly signalled his preference for the RBNZ to put conditions on the FLP, recognising the concern funding could flow straight into the housing market.

National’s shadow treasurer Andrew Bayly in November also openly called for the RBNZ to put conditions on the FLP.

Prime Minister Jacinda Ardern criticised Bayly at the time for suggesting the Government interferes with the RBNZ’s independence, comparing him to former Prime Minister Robert Muldoon.

But as it turned out, Bayly was joined by not only Robertson, but also Treasury in thinking there should be some conditions tied to FLP funding.

Treasury’s advice

A document released to interest.co.nz under the Official Information Act shows Treasury on August 6 told Robertson: “You may also wish to signal your support for the Bank considering additional incentives for SME and business lending.

“Such incentives would complement broader Government objectives to support firms, particularly SMEs, in the economic recovery over the medium term…

“The Bank has options to design the FLP in a way that helps ensure that: lenders’ lower funding costs are passed on to their customers; new lending is allocated to productive parts of the economy; and financial stability risks are managed.”

Treasury also noted: “[A] lack of competition in the banking sector could mean banks use reduced funding costs to boost profits instead of passing it through to retail rates.”

Treasury’s advice came a week before the RBNZ said a FLP was a tool it could potentially use, and seven weeks before the RBNZ confirmed it would get ready to deploy such a programme by the end of 2020.

The RBNZ’s position

The RBNZ last year explained putting conditions on the FLP could constrain its uptake. If banks don’t take the opportunity to borrow cheap money (at the Official Cash Rate, which is currently 0.25%), they might not lower interest rates.

While the FLP supports liquidity, it is being deployed to boost inflation and employment in line with the RBNZ’s monetary policy mandate.

The RBNZ has stressed the monetary policy tools at its disposal are blunt, and its job is to support the economy as a whole, not direct credit to certain sectors.

Speaking to interest.co.nz in November, RBNZ Deputy Governor Geoff Bascand put the onus back on the Government.

“If you want to direct lending, that's really a government policy decision or initiative,” he said.

The piece of Treasury advice interest.co.nz has didn’t go down the path of exploring whether the Government could do anything to ensure FLP funding got to productive parts of the economy.

It didn’t specifically raise concerns around the provision of cheap funding and lower interest rates setting the housing market on fire. Both the RBNZ and Government were throwing a lot at keeping the economy afloat in the face of dire economic forecasts at the time.

FLP likely to become more effective later in the recovery

It’s worth noting that unlike the RBNZ’s Large-Scale Asset Purchase Programme, the FLP didn’t need to be indemnified by the Government.

However, the RBNZ wanted Robertson’s “endorsement” prior to publicly consulting on the design of the FLP. Treasury suggested Robertson provided this endorsement.

It believed the FLP would “likely make existing lending cheaper and, at the margin, may incentivise new lending”.

“FLP is unlikely to have a transformational effect on willingness to borrow or credit standards applied to borrowing,” Treasury said.

“To the extent that FLP transmits by easing funding costs, it will be most effective in supporting real activity where funding costs are suppressing bank lending.

“Right now, these seem like marginal constraints as uncertainty seems to be a larger drag on businesses’ and banks’ willingness to borrow and lend.

“However, FLP is likely to be more effective later in the recovery, as uncertainty recedes and credit demand increases.”

Indeed, bank lending to businesses fell off a cliff in 2020, while lending for housing shot up.

It's too early to see the impact of the FLP. There have been three drawdowns from the FLP, totalling $1.14 billion, since its December launch.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

18 Comments

I find this all very interesting given that GR go-to answer is that he's waiting on advice from Treasury!

'Document reveals Treasury - like National - wanted the RBNZ to put conditions on its Funding for Lending Programme to direct cheap funding to businesses'

RBNZ knows that people will be borrowing for putting money in housing market and that is what Mr Orr wanted so why would he put condition as that will violates the very purpose of what Mr Orr wants and also his poltical supporters Jacinda Arden, so why would he put condition.

This again highlights the intend of government and RBNZ to support housing ponzi.

Still no words from FM or PM on weekly rise in house ,price in double digit.

And it is best if there is no statement from the PM or FM re house prices because when they speak their audience is international and their words fuel the fire.

Exactly, with the signals they send out it's just better that they don't open their gobs

That's wonderful but I would remind those lovely, enlightened specimens in Government, RBNZ and Treasury that finger pointing isn't fixing the problem or making any of them look good. All of that lovely money is out there, being deployed by banks right now to bring even more 'fairness and balance' to the housing market.

That's wonderful but I would remind those lovely, enlightened specimens in Government, RBNZ and Treasury that finger pointing isn't fixing the problem or making any of them look good.

This is the curse of the bureaucratic class. Ultimately, they're not responsible or accountable as someone might be in the private sector. There is no way that Robbo and JA can understand this. Their whole professional lives have been closeted in that world and they've been groomed by the people who champion the bureaucratic class and believe in it. They're simply behaving and operating in the manner in which they've been conditioned.

That's wonderful but I would remind those lovely, enlightened specimens in Government, RBNZ and Treasury that finger pointing isn't fixing the problem or making any of them look good.

This is the curse of the bureaucratic class. Ultimately, they're not responsible or accountable as someone might be in the private sector. There is no way that Robbo and JA can understand this. Their whole professional lives have been closeted in that world and they've been groomed by the people who champion the bureaucratic class and believe in it. They're simply behaving and operating in the manner in which they've been conditioned.

It has been revealed Treasury advised Finance Minister Grant Robertson to suggest the Reserve Bank (RBNZ) attaches conditions to its $28 billion Funding for Lending Programme (FLP) to direct newly-created money to productive parts of the economy.

The RBNZ in December started offering banks cheap loans to help them lower their interest rates to stimulate the economy. While these loans are secured, banks can do what they want with the funding.

How does this work given the constraints of repurchase agreement accounting - exhibit 2, while the scheme is directed at banks already in possession of the eligible investment securities collateral?

Surely the creation of new bank credit is conducted in the normal way via exchange of borrower and bank IOUs, after the repo trade is executed and settled?

This program is yet another attack and fraud perpetrated by monetary policy (the state) on that group in New Zealand who could least afford it: elderly and prudent savers.

Despite the current pressure on bond yields which should be working into higher mortgage and deposit rates, this program allows banks to keep their lending rates low while offering nothing to savers who are stuck on obscene term deposit rates (negative real rates) of 0.80%.

Disgusting.

Meant to mention above it's even worse than this: I'm also in bond funds which are seeing their returns slaughtered since New Year as bond yields are rising, so, for prudent/elderly/risk averse savers:

1. There is negative returns in term deposits with no hope of movement off historical lows due solely to this government program;

2. Those of us also in bond funds are seeing our annualised returns this year now go below 2.5% and falling.

If the RBNZ and Treasury wanted to screw savers to the profit of speculators any better, other than just destroying the digital entries that represent our term deposits I can't think of any better way for them to have done so.

This was deeply immoral. The only thing we did right this year was buy another house; but that was not our preferred option.

As a prudent saver - I can relate.

This program is yet another attack and fraud perpetrated by monetary policy (the state) on that group in New Zealand who could least afford it: elderly and prudent savers.

Do savers really exist? We don't have any good data that helps us really understand this in a meaningful way. But I do agree with you that the elderly and savers are screwed. Nevertheless, they might be less screwed than the young and those without the proverbial 'silver spoon.'

"Won't someone think of people with stacks of cash lying around" indeed.

What are you saying here? You think savers are the villains in all this?? Yet if you heroically pour your money into residential property you are entitled to obscene capital gains? Intriguing point of view you have.

All this bull dust of "the RBNZ is independent!", was basically JA and GR saying "we don't understand the problem, so are handing it off to someone else, who doesn't have the framework they require to achieve our goals, but we don't understand that because... we don't understand the problem.

Because the RBNZ act section 12 literally says the government can direct them what to do. And the government can, at any time, change the act. It's blindingly obvious the RBNZ is not independent of the government.

Can we get someone competent in these top positions please? It looks like half the commentators on this site would be better than GR, which is a sad indictment of us as a country and the horrific choices we have when selecting our leaders.

Another day another damning insight into the incompetence and stupidity of Jacinda Ardern.

This housing crisis is her housing crisis.

How many finance ministers are we up to now, where they dribble on to their collar when it comes to monetary policy? I've lost count

Shocking… terrible it's so blatantly obvious that the FLP should have been aimed at businesses, the government is just full of inexcusable excuses for not making it happen

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.