The housing market could be heading for a difficult winter as the mountain of unsold stock continues to grow, and new listings come onto the market art a much greater rate than actual sales.

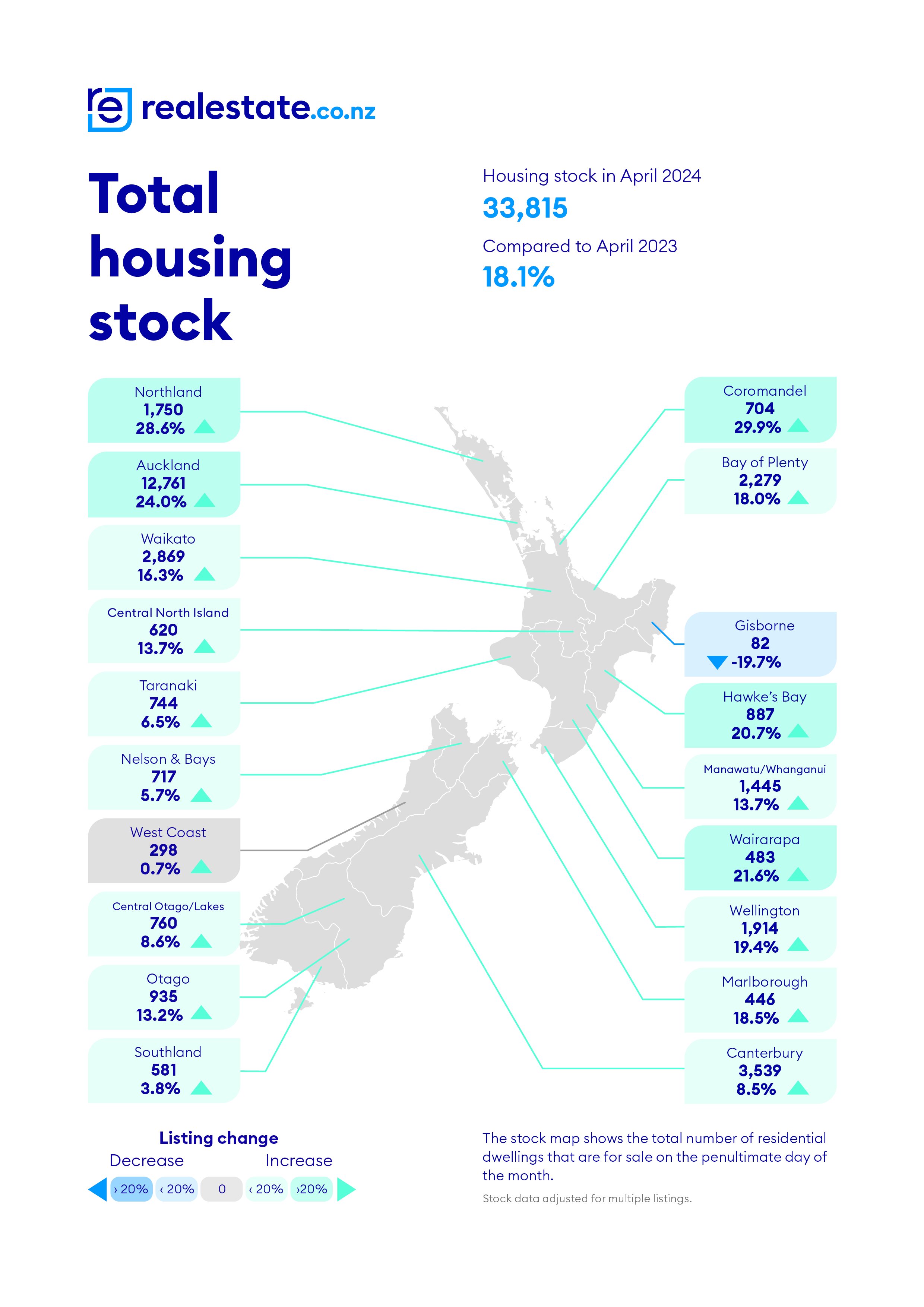

Property website Realestate.co.nz had 33,815 residential properties available for sale at the end of April, the highest level of stock on the site since April 2015. It's also up 18.1% compared to April last year.

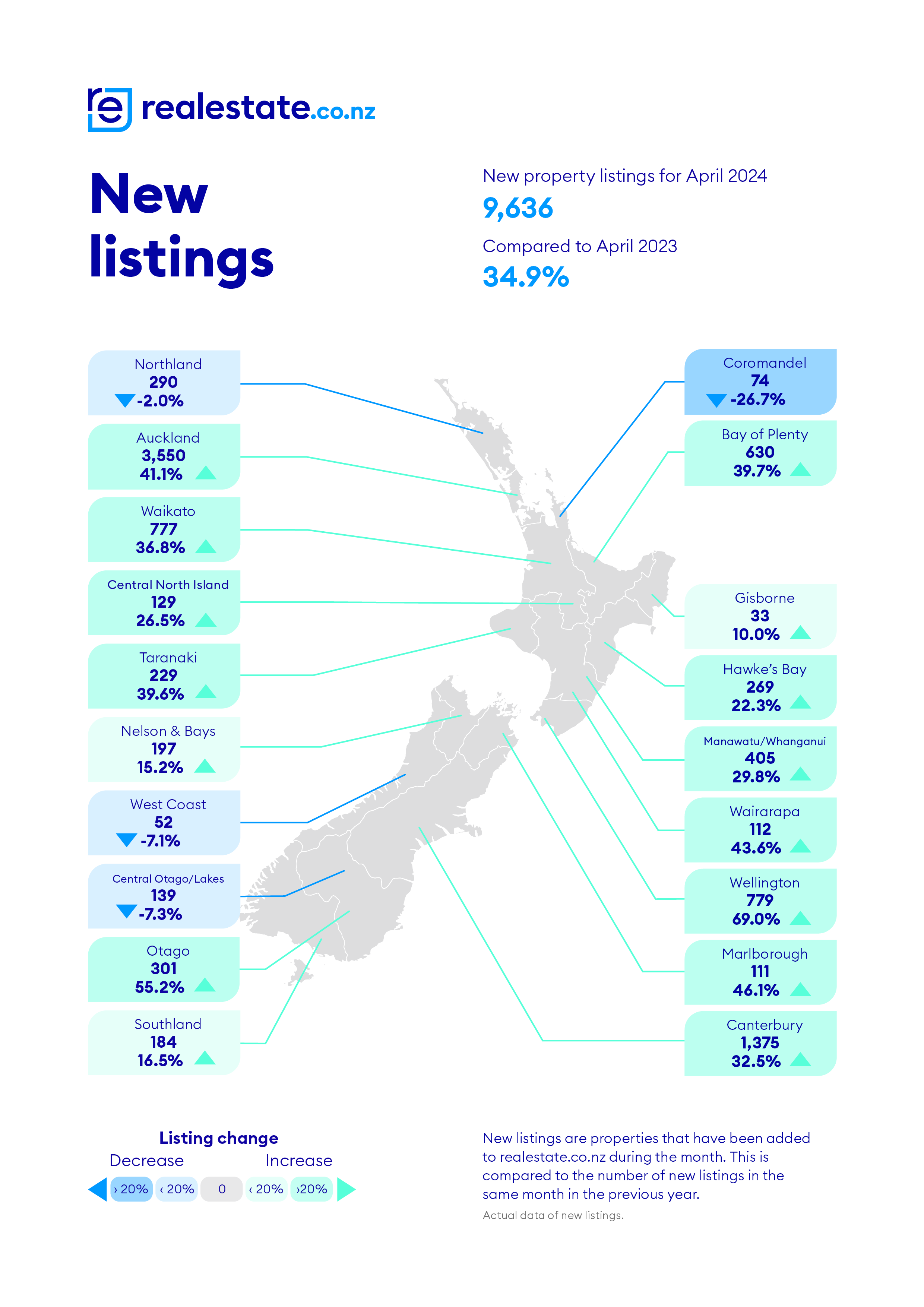

The basic problem can be seen in the March figures, when Realestate.co.nz received 11,455 new listings, but in the same month the Real Estate Institute of NZ recorded just 6521 sales.

Essentially more properties are coming onto the market than are selling, and the stockpile of unsold properties for sale keeps growing.

That leaves vendors with unsold properties facing some difficult choices.

Do they drop their asking price to try and tempt potential buyers?

Do they take their property off the market to try again at some future date?

Or do they leave their property languishing on the market and just hope things get better?

None of these options is likely to be particularly palatable.

Realestate.co.nz Chief Executive Sarah Wood said the number of searches per listing on the website were down 10.4% compared to this time last year and engagements per listing were down 7.5% over the same period.

"This indicates a cooling of buyer interest amid economic uncertainty," Wood said.

"It is a significant shift as most regions have experienced year-on-year demand growth during 2024 until now. In response to the recession, buyers are understandably cautious," she said.

The comment stream on this story is now closed.

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

77 Comments

Unsold inventory ⬆️ prices ⬇️ It's a well entrenched buyers market. If buying - take your time.

Nahh - my really good friend Tony A said we have plenty of quick cuts incoming. We all know what that means 😎

-SMG.

I had mixed feelings about the market at the beginning of the year, thinking if I waited more it could actually end up being more costly. Now I realise time is my best friend. Agents are calling me back for properties now priced much lower than 3 months ago after the pretended multi bid offers never materialised... Really curious to see what will hapen over winter.

Agents seem to love these multi offer situations, whether real or imaginary.

I think its because sellers have been waiting on the sidelines until more recently, while buyers returned last year

You think?

This market will hit rock bottom over next two years

Not that way in Australia but they have gone to the same dump place that we went to on house values and the consequences of this is huge social issues seen this all before in NZ.

Australia ripe for a huge haircut don't waste your time and money going to Aussie you will be know better off than in NZ and social issues 100 time worse.

Depends on who you know over there to some degree and where you go. I have friends who have managed to find accomodation etc in major cities but know of others that are couchsurfing around as they can't find accommodation for a couple of months and lines down the road for flat viewings. Like us, it won't be long until they clamp down hard on immigration.

Just wait until July when even more distressed inventory gets added.

The new Brightline rules come into effect. 10 years to 2.

Exactly. Many will be itching to jump post 01-July for sure. Knowing this is a possibility, another cohort unaffected by Brightline will be listing to exit ahead of 01-July flood. Animal instincts on the ride down applies.

All these people blithely evading tax due on capital gains when buying and selling for the purpose of capital gains. Shocking. Should be in boot camps.

So your answer is to provide these people free food and lodgings?

IRD might be more compelled to enforce the "Intention Rule" pressured by a fiscally challenged Government.

"The intention rule applies no matter how long you keep the property before selling it"

https://www.ird.govt.nz/property/buying-and-selling/when-you-need-to-pa….

We are witnessing a seismic shift in the overall cost of debt in real time and more rigid enforcement of the intention rule could be one outcome. It's not a "new" tax as such.

You're learning the ins and outs of tax regulations, you could/should apply for a roll at IRD. As their online inspectorate

by Flying high | 1st May 24, 8:59pm "You're learning the ins and outs of tax regulations, you could/should apply for a roll at IRD. As their online inspectorate"

Should I apply for a "roll" of the sausage variety or a "role" that pays a salary?

Yes troll a roll. But I'm glad you picked up on my era

Btw did anyone notice the flaw in the argument above. That those who bought investment properties after march 2021 have been holding off selling to avoid tax on profits. They'll be lucky if it's not a paper loss

The only others caught by the BL test are investors who bought investment property between July 2019 and March 2021. How many potential sellers would that be

The listing heading into the reduction of the flipper tax window is starting to surge. Those that purchased in the peak stupid window better be prepared for a haircut. Alternatively they can remain in lala land unless they can offer 2% vendor finance for 25 years.

Popcorn getting crispy

Ah, the old supply/demand equilibrium price point...who knew

If they can't sell it, then they should be able to make money by leaving the property empty or bulldozing it. Or so I've read somewhere...

Depends on your level of debt and demands around it. Its is after all 4-5% higher than peak stupid.

There is no light at the end of the tunnel !

Another TTP.

Armageddon undiluted!

Another Chairman Motor Moa (making his usual hullabaloo).

TTP

Corelogic results show the overall house value has grown by 0.6% in NZ over the last 3 months. If this is Armageddon I'll take it.

Can you not see the stress starting to show in risk assets worldwide as inflation will not roll over.... just wait to the coming repricing impacts peoples Kiwisavers at the same time it smashes their biggest asset.

I am wondering if the stockpile is having an upward effect on rents at the moment. Most rentals will evict tenants when a house goes on the market (Its a nightmare trying to sell a tenanted house). Assuming just 50% of the houses for sale in Auckland are rentals, that's 1700 fewer houses for rent atm.

Apparently not: https://johnbutt.substack.com/p/nzs-balanced-rental-market

There is an "8% oversupply" of rentals according to this article, primarily in Wellington, but that's no surprise.

I question his theory on 2.5% being the threshold for over supply/ under supply. The he has shows the vacancy rates bouncing between 2.3 and 2.8%. Surely such a small movement is statistically insignificant?

It’s good work, and I agree Auckland is a little oversupplied. A good thing!! It’s oversupplied because of all the new townhouses being finished, en masse. Despite high population growth.

It will be interesting in a year or two once supply has ground to halt. Yet, population growth will slow, perhaps significantly, which could minimise the degree of under supply.

Rules have changed back to what they were around exiting tenants. Just make settlement window comply with 90 day window.

Not yet. Legislation to be put forward this month, with it coming into effect early 2025. Only thing that has changed so far is the tax treatment (rules around interest deductibility from 1 April and the Brightline roll back from 1 July).

Only on the news last night, rents are skyrocketing.

Zwifter, the news media have also reported on skyrocketing insurance, rates and resetting mortgage interest rates too and it's still cheaper to rent! Going forward, as jobless migrants head back home, less will come combining with native talent still heading to Australia. This will likely place downward pressure on rent prices in the near term.

Weren't you one of those on here pushing rampant inward migration as the primary catalyst in support of rising house prices? As predicted, nothing happened. Backward focused assumptions that migrants always bring with them untold wealth is foolish.

Yeah this could be quite ugly for recent migrants, who often spend a lot of money getting here..... Those joining partners probably have better situation, but a lot of very low skilled recent migrants may get displaced by desperate kiwis who will accept $28 and hour as a stop gap job.

There was also that recent tiktok trend of folk finding empty houses and posting locations for other folk to squat in them. Be interesting for supply/demand if that picks up.

Anecdotally, I'm hearing a lot of unsold properties are being withdrawn and put into the rental market. Which goes some way to explain the sudden surge in rental listings (combined with restoration of interest deductibility on post 2021 rental purchases). This should show up in flat or falling rents soon.

Steps to prosper:

- Kick tenants out in order to sell.

- List for 6mo, can't sell, pull the listing.

- Put house on rental market, can't rent, pull the listing.

- Bulldoze and make bank.

I really haven't heard of a landlord not finding a decent tenant in a short space of time recently. I'm in Auckland so maybe the situation in wellington is quite different. Landlords have other stresses ATM but finding good tenants is not one of them.

Bad tenants are kainga Ora's problem now. And the taxpayer.

"Vendors with unsold properties will face some difficult decisions heading into winter"

Good.

NZ house prices are still some of the highest in the world relative to income.

That's the problem/point. We have to take our medicine and rebalance the economy. The longer we wait to do it.. the harder it will be

This has been the message for at least a decade - so we have chosen harder.

Entitlement Mentality to free money from property is hard to budge. Ends up costing the country a lot in property welfarism over the years.

I totally agree. I'm seeing minor price adjustments, but sellers need to get a reality check - drop your prices.

Just saw a very nice house on a 700sqm section in a decent area drop their price by 9%. Been sitting on TradeMe a month or two already.

Prices down 10% between xmas 23 and xmas 24

I keep saying it......

That leaves vendors with unsold properties facing some difficult choices.

Do they drop their asking price to try and tempt potential buyers?

Do they take their property off the market to try again at some future date?

Or do they leave their property languishing on the market and just hope things get better?

Time constrained sellers may need to accept the only offer that they get.

A non time constrained vendor (who is a property trader) has had their owner occupied property listed for sale for 15 months.

They have cut their asking price and only just put an asking price on their sale listing. And in the revised sale listing "Price reduction. Vendor meets the market"

The once flowing tap of greater fools has slowed to a drip.

Case in point - https://www.realestate.co.nz/42396105/residential/sale/1209-puketitiri-…

This house is owned by the manager of a local real estate firm. Originally wanted $1.7m (dreaming) Now priced at $1.57m. Been on the market 8 months now. They scoffed at a cash offer from someone I know of $1.4m when first listed.

They purchased for $565k in 2010 and made no changes to this 1960s house. Yet they expect 3x what they paid. Market value is likely to be somewhere between $1.3m and $1.45m. The longer they wait the lower the price. Comparable $1.5m listings are far superior to this one.

This is what I see also. Sellers expectations are totally unrealistic.

I suspect they're also not taking into account the Gabrielle Effect, whereby buyers are nervous about areas like Puketapu. It also doesn't help that the current Google Maps satellite images are of the area were taken a few days after the cyclone.

given its location its real value is still under $1 mill.

ah, winter, I hope it snows.

The only "housing market resilience" going on here is the intense resilience vendors face when trying it on with increasingly scarce and cautious buyers. Bag holders are facing some increasingly difficult decisions that only yesterday were considered inconceivable.

What's the gross yield vs purchase price looking like for resi purchases at the moment? Anyone been following the trends in their area?

There's properties in our area (Hibiscus Coast) where the vendor is still in COVID era lala land asking for prices which would yield 3-4.5% from rental income for both resi and commercial. Those properties have been listed for months, some getting close to a year

3-5% seems to be fairly standard from what I've seen. Some small towns and areas surrounding Christchurch I believe have 5-10% yields? Don't quote me on that, those are grapevine stats.

In Wellington though, a large amount of listings piling up with the 3-4.5% estimated or appraised yield. Then a large amount of rentals piling up at that rent level. Seems like rents are too high for tenants, then prices are too high for rents. Good time to kick half the city out of work I guess.

Interesting to hear and see the gross yield clearance rate ticking up slowly, but still no party for anyone with high leverage and 6-7%+ loans such as fhbs

3-4.5% gross yield for the Auckland region (Hibiscus Coast) is an improvement on the Covid era. From memory, yields for Auckland were somewhere around the 2-3% range during the Covid peak, if I am not mistaken?

You're probably right. I can remember plenty of people asking for ~2% yield but couldnt remember seeing much actually selling at 2% in my area (not that I obsessed over that kind info), so wrote 3% to safe.

I invited someone with better records or access to stats to make a more informed comment.

Regardless, the takeaway is that yield in our area has risen mostly through land price drops rather than hefty rent increases

Gross yields are a thing of the past unless you think past capital growth will continue at the same rate into the future.

Not in the near term, that's my point. Yields are slowly aligning closer to interest rates, with a corresponding drop in land value.

Last time I did the numbers for an environment of falling interest rates, gross yield followed interest rate changes with a lag of 12-16 months, and a discount of 1.4-1.8%. This had good correlation for the 10 years I looked at to December 2021.

now that we're in a rise-and-hold interest rates environment, the discount numbers are similar but the lag has been longer to reach those.

Interesting to see how the dynamics from factors other than interest rates are and will play out. Will vendors be willing and able to hold on, meet the market or join the rental market and top up a few hundred every week to keep their 'investment'?

House prices will remain stable until unemployment increases. I don't see that happening until about Tuesday next week. . .

The key task of house buyers at the moment is to sniff out the most motivated vendors.

most of the site spruikers are reduced to making jokes.......

*Crickets*

Not gonna to lie, it's refreshing not having all the usual spruikers talking up their usual garbage. I'm sure they will all emerge from their caves at some point in the future. When that will be no one knows.

As I have mentioned a number of times since 2022, housing downturns take years to play out.

Canada in the 90's was 10 years of stagnation from a 1989/90 peak.

USA 2008 through to 2014.

Ireland 2007 through to 2021.

NZ 2022 through to 20??

Average household income is around 140k if they have 150k deposit saved should be able afford 750k property this won’t buy much in Auckland, the 20% crash from highs will continue for next couple of years and then bounce at bottom for a number of years as over leveraged and people who didn’t see downturn coming and we’re expecting low rates forever, lick their wounds.

the issue is all the other crap eating at the 140 less tax.... what you can pay is falling way faster then house prices ie

the bid is backing away from the offer forming a massive spread.

Its a non functioning market, hence low sales numbers, low new mortgage growth, and desperate RE agents needing turnover to pay the bills.

I think many AKL real estate shops must be looking very closely at there numbers.

Its not a lack of listings.........

Yep. Greed and expectation of tax free is a strong driver.

I would suggest it would be very challenging indeed for a household on 140k to service a 600k mortgage, especially if they have a child or two.

Hard agree. I can tell you that my similar situation with a 350K mortgage is already very testing. I almost never eat out and rarely eat meat at home (wife veggie). I cycle to work three times a week and I subscribe to just one streaming service. No gym membership and I can't recall the last item of new clothing I bought. My luxury is a $22 six pack each week and sometimes I forego it. Only one child has full time care. Sometimes I save a couple of hundred bucks, sometimes I can't. Tough out there.

Will be interesting to see how many houses go on the market 1 July when bright line drops to 2 years.

I suspect a blood bath with sellers accepting offers somewhere between June market value and the amount they would have got after a 30% brightline tax.

As the Carpenters once famously sang :

"And yes, we've just begun....."

Prices are going lower for sure. Why? US Fed is delaying cuts, NZ will follow, inflation still persistent. Net immigration was super high adding to this pressure, although taps are now turned off. Flood of properties online July brightline test to 2 years, investors sell to lock in gains! Job losses and recession means consumer demand/mood is down, just beginning to materialise. It will be at least 18months before property market bottoms. Bank interest rates will not go back down under 5% - higher for longer. Asset values need to correct to this new reality. Gravity always wins eventually. Things to recover 2027.

I was agreeing with your comment until I got to the 2027 recovery forecast. What makes you think there will be a recovery then? I guess it depends on how much further they fall in the interim. If they reach some measure of fair value, like another 30% lower, then perhaps 2027 may be a positive year. But what does recover mean - recover peak prices?? No chance. (Actually from a buyers’ perspective, “recover” means recovering value, ie prices lowering)

Recovering house prices - lowering them to a point where society can function, and social cohesion exists. I like it.

Alaron just axed 139 jobs in Nelson. Several comments online of folk selling up and moving to Oz as a result as there's only so many job prospects around and they paid semi-well at that place.

.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.