Here's my Top 10 links from around the Internet at 11 am in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

My must watch today is Hugh Hendry. Hilarious, reckless and fearless. I'm glad he's not running any government, but he is fun to watch.

1. Milk for 75 NZc a litre - Der Spiegel reports (in German) that Aldi supermarkets is selling milk for 45 Euro cents a litre (75 NZc a litre) after a surge in production saw the price forced lower in renegotiations of contracts between farmers and supermarkets.

The best price per litre you could get in New Zealand at the moment is 4 litres of Dairy Dale for NZ$6.75, which works out at around NZ$1.69 a litre. Nosh is apparently selling milk for NZ$1.25 a litre.

Wouldn't milk at 75 cents a litre be nice for consumers here?

Not so much for farmers though...Time for local prices to reflect global prices?

Here's the clip from Der Spiegel, for purely entertainment reasons, just to say we're a multi-lingual site. I welcome translation in the comments.

Fettarme Milch (1,5 Prozent) kostet damit 45 Cent, Milch mit einem Fettgehalt von 3,5 Prozent kostet 51 Cent. Auch Butter wird erheblich billiger. Für eine Packung müssen Kunden 75 Cent zahlen und damit 14 Cent weniger. Der Preis für Schlagsahne wurde von 43 Cent auf 37 Cent gesenkt.

Grund für den Preisrutsch ist die jüngste Verhandlungsrunde zwischen den einzelnen Molkereien und Handelskonzernen über neue Trinkmilchverträge. Die Kontrakte gelten in der Regel für ein halbes Jahr. Bereits im November 2011 war Trinkmilch um etwa zwei bis drei Cent je Liter billiger geworden.

Die aktuelle Rabattrunde im Einzelhandel fällt stärker aus als von Produzenten befürchtet. In den vergangenen Wochen gab es Berichte, dass erste Abschlüsse in der Preisrunde Abschläge von Molkereien gegenüber Handelsriesen von vier bis 4,5 Cent je Liter Trinkmilch vorsähen.

"Wer Lebensmittel verramscht, ruiniert unsere Bauern"

2. Eurofailure yet again - Reuters reports Europe's leadership failed yet again overnight to hammer out a deal for new capital rules for its struggling banks.

A summit to hammer out a deal broke up in acrimony with the English accusing the French and Germans of trying to water down rules for tougher capital requirements.

Britain's George Osborne accused fellow EU finance ministers of trying to water down Europe's bank capital rules and said this would make him "look like an idiot", as talks about a law to stop another financial crisis unravelled in Brussels.

In remarks at the negotiating table, Osborne, who says he wants much tougher controls to avoid a repeat of the current crisis, fumed that regulation being discussed could dent the credibility of Europe and harm London, its top financial centre.

Michel Barnier, the EU commissioner in charge of financial regulation, accused Osborne of seeking an opt-out with a proposal that would let Britain impose higher capital ratios on its banks than elsewhere in Europe - something France and others fear could disadvantage continental institutions.

"London is a very important centre but... there are other centres alongside London which also merit consideration," said Barnier, a former French government minister.

3. Extractive elites - Buttonwood writes at The Economist about a new book about how 'extractive elites' in economies such as Russia, China and corrupt African dictatorships eventually fail because they stop 'creative destruction' from happening.

Buttonwood reckons the banking sector and governments have become the extractive elites of the developed world.

In their new book, “Why Nations Fail: The Origins of Power, Prosperity and Poverty”, Daron Acemoglu and James Robinson, a pair of economists, suggest that many countries are bedevilled by economic institutions that “are structured to extract resources from the many by the few and that fail to protect property rights or provide incentives for economic activity.” In contrast, “inclusive” economies distribute power more widely, establish law and order, and have secure property rights and free-market systems.

There are two potential candidates for extractive elites in Western economies. The first is the banking sector. The wealth of the financial industry gives it enormous lobbying power, including as contributors to American presidential campaigns or to Britain’s ruling parties. By making themselves “too big to fail”, banks ensured that they had to be rescued in 2008.

Much of current economic policy seems to be driven by the need to prop up banks, whether it is record-low interest rates across the developed world or the recent provision of virtually unlimited liquidity by the once-staid European Central Bank.

A second candidate for the extractive-elite category is the public sector. In some countries, such as Greece, there has been a clear policy of “clientelism” in which political parties have rewarded their supporters with jobs and benefits that have been funded by the general taxpayer. In the Anglo-Saxon world, public-sector employees now have more generous pension rights than the majority of private-sector workers.

4. Hugh Hendry's latest - Eclectica Fund Manager Hugh Hendry is well known for his provocative and often doom-laden views on global financial markets. Here's his latest on Europe in the video below and via Zerohedge, which says Hendry says: "You can't make up how bad it is."

"The political economy in Europe is such that the politicians chose to default on their spending obligations to their citizens in order to honor the pact with their financial creditors and so as time goes on, the politicians are being rejected."

5. Higher inflation - New York Times columnist and Nobel prize winner Paul Krugman argues here for higher inflation to help solve the US economic crisis.

Essentially, Krugman argues that Bernanke changed his mind on the need for the Fed to tolerate higher inflation in the short term over the past several years for two reasons. First, "basically the Fed staff doesn't like adventurous policies. To some extent he's been converted by the Fed's internal culture." Second, Krugman believes Bernanke and the Fed have been subject to political intimidation. Remember Texas Gov. Rick Perry's now-infamous "treasonous" attack of last year?

"The main thing the Fed can do is promise that they will be very slow to step on the brakes, that as the economy recovers that they will let inflation rise, not to high levels, but to 3 or 4 percent from two percent," Krugman suggested. "That would move the markets quite a lot. It would lead people who are making plans to think that sitting on cash is not a good idea. That's the strategy Bernanke urged on the Japanese twenty years ago."

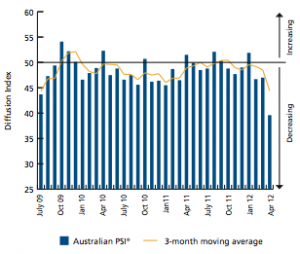

6. Something just snapped in the Australian economy - Houses and Holes writes over at Macrobusiness that yesterday's Australian services sector contraction was dire.

This report is suggesting that we are headed into recession. Add in the R.P.Data Index of a resumption of house price falls in April and I’m getting the distinct impression that we’re going through some kind of freeze in aggregate demand.

If I had to pick a cause, I’d say that the bank’s shift to unilateral interest rate moves has dramatically undermined confidence in the RBA insurance policy. Folks are headed into their shells. We might also speculate that this is why the RBA pushed the panic button, it may have picked this up in its industry liaison or one of its other proprietary data sources.

7. Still falling - CNBC reports Chinese house prices fell in April for the 8th month running.

Price drops failed to stimulate sales, however, as transactions declined in 80 percent of the 40 key cities monitored by CREIS. Transactions fell by 26 percent in Shanghai in April from March and by 4 percent in Beijing. The CREIS data offers the earliest monthly look into China's real estate market performance.

A Reuters weighted home price index, based on official data published by the National Bureau of Statistics, showed China's average new home price fell in March from a year earlier - the first such fall since the government began to curb property speculation two years ago.

Analysts polled by Reuters last month predicted Chinese home prices will likely fall by a further 10-20 percent between April and December this year, after slipping 5 percent in the first quarter.

8. The only way out - Jeremy Warner writes at The Telegraph that the only sustainable way out of the European debt crisis is the abandonment of the euro and a return to free-floating sovereign currencies.

Only then will Europe's seemingly interminable debt crisis be lastingly resolved. All the rest is just so much prancing around the goalposts, or an attempt to make the fundamentally unworkable somehow work. The latest eurozone data are truly shocking, much worse in its implications both for us and them than news last week of a double-dip recession in the UK. Even in Germany, unemployment is now rising, with a lot more to come judging by the sharp deterioration in manufacturing confidence. For Spanish youth, unemployment has become a way of life, with more young people now out of a job (51.1pc) than in one.

There is only one boom business in Spain these days – teaching English and German. No prizes for guessing where these students are heading.

It's an insightful read.

Before I occupied Wall Street, Wall Street occupied me. What started as a summer internship led to a seven-year career. During my time on Wall Street, I changed from a curious college student full of hope for my future, into a cynical, bitter, depressed, and exhausted “knowledge worker” who felt that everyone was out to screw me over.

Poker is extremely popular across Wall Street, and provides an instructive lesson. The book Poker Winners Are Different by industrial psychologist and poker adviser Alan Schoonmaker presents a scenario where a player notices his best friend’s “tell”—that is, the best friend has a habit of showing when he has a good or bad hand. The book then poses the following dilemma: should you (a) tell your friend, (b) win a bit of money from him, and then tell him, or (c) exploit your friend, never telling him. The correct answer: screw your friend. Schoonmaker, who used to do “management development” work at Merrill Lynch, writes that winners will “do whatever the rules and ethics allow to maximize their profits.” This behavior is heralded in poker and it’s heralded on Wall Street. Despite what may be emblazoned on plaques or in mission statements, the ethics of Wall Street are purely about winning at any cost.

10. Totally Clarke and Dawe - Australian Foreign Minister Bob Carr tested his pre-conceived ideas in a recent meeting with Fiji's Frank Bainarama.

55 Comments

Bernard..!....... The E.U. is not a dead duck.!.... it's just a duck on fire ,waiting to be stomped out by the Elephant in the room.

Krugman on Bernakie...assimilated by the Borg....!! couldn't have said it better myself.....utter capitulation by Benakie to conform to the will of the Puppetmasters.

Choice Bernard. Happy to, would you like to write the CAP cheque a la Europe-style.

From WikiP: Each country can choose if the payment will be established at the farm level or at the regional level. Farmers receiving the SFP have the flexibility to produce any commodity on their land except fruit, vegetables and table potatoes. In addition, they are obliged to keep their land in good agricultural and environmental condition (cross-compliance).[22] Farmers have to respect environmental, food safety, phytosanitary and animal welfare standards. This is a penalty measure, if farmers do not respect these standards, their payment will be reduced.

The direct aids and market related expenditure make up 31% of the total EU budget. The total CAP budget is 42% of the EU budget (31% -direct aid + 11% – Rural Development).[23] It represented 48% of the EU's budget, €50 billion in 2006, up from €48.5 billion in 2005.[

Milk quotas will expire by April 2015. Therefore in order to prepare the dairy farmers for this transition, a 'soft landing' has been ensured by increasing quotas by one percent every year between 2009/10 and 2013/14. For Italy, the 5 percent increase will be introduced immediately in 2009/10. In 2009/10 and 2010/11, farmers who exceed their milk quotas by more than 6 percent will have to pay a levy 50 percent higher than the normal penalty.

The point you make is interesting re Aldi. In Australia the average shopping basket from Aldi is consistently 25% cheaper that either Coles or Woolworths.

http://www.streetcorner.com.au/news/showPost.cfm?bid=12683&mycomm=WC

Aldi, the only significant competitor to the Coles and Woolworths duopoly, was 25% cheaper on a comparable basket of goods.

For the first time CHOICE included fresh food in its price survey and found that prices were markedly lower in areas with greater population and competition.

http://www.mumsgone2aus.com/2011/07/27/mum%E2%80%99s-ultimate-australia…

Australian supermarket shopping basket comparisonLast week, in Sydney, I compared the price of 23 products, in four of the main Australian supermarkets: Coles, Woolworths, Franklins and Aldi. I chose products that we buy weekly or fortnightly. This is what I discovered:

The ranking from cheapest to most expensiveAldi $63.86

Coles $79.04

Woolworths $82.70

Franklins $86.20

The ranking surprised me because I thought Franklins was cheaper than Coles and Woolworths. I was glad to see that my effort to shop at Aldi isn’t in vein.

Cheers. Yes. Google translate is hilarious.

Thanks for the Aldi comparison in Australia. I wonder how they can offer such cheap prices.

cheers

Bernard

Going off on a tangent, whos going in on the Facebook IPO?

Re#1 translation:

Low fat milk (1,5%) is 45 cents, milk at 3.5% fat content is priced at 51 cents. Butter also is considerably cheaper, for a package customers have to pay 75 cents, this means14 cents less. Price for cream was lowered from 43 cents to 37 cents.

Reason for the slide in prices are the latest negotiations between different milk processing plants ( Dairies) and retail trading companies (corporates) regarding the new contracts for drinkmilk. The contracts are usually valid for 6 months. Already in November 2011 drinking milk became cheaper by around 2-3 cents per liter. The actual discounted price at the retail sector is more than the producers feared.

In the last few weeks there were reports that the first contracts during price negotiations between dairies and the retail giants (Supermarkets) envisaged a discounted (lowered) price of 4,5 cents per liter drinkmilk.

"He who makes rubbish (junk) of our food products, is the ruin for our farmers"

Gertraud

That's much better. Cheers for the human involvement.

cheers

Bernard

Translation of a passage further down in that article:

"Fact is, more than ever is being produced" said the Deputy CEO of the North Rhine-Westphalia Dairy Organisation Gerd Krewer. "In 2011 the volume rose by 2.4% to 29.3 million tonnes."

Ponder that it is not unknown for the EU to dump agriproducts on to the world market.

btw: "litre" = british, "liter" = US, both correct

In Aussie its not acutally Milk anymore. Go to the super market and you won't find the label milk on the bottle. Its full of Permeate - left overs from Cheese making.

A2 is probably the only thing closest to milk at the moment.

And even more amazing is the retail price of "skim milk" and "low-fat" milks. Shows how gullible people become. Low-fat milk is what's left afer taking out the milk-solids and they charge more for it than the BS permeate labelled as "Full-Cream-milk".

That's the trouble with news aggregators. They see a sensational headline and run with it. Don't check the facts. Aldi in AU is the main culprit in the watered-down-milk trick. They either learnt it from their parent company in Germany, or the German parent if not the perpetrator will have learnt it from their offspring. Now the challenge for Bernard is to do the research and check the facts and find out if it really is milk or was he just doing the re-production thing again. The question is: maybe they can water it down even more in germany and still call it milk.

Im sure the right wingers will be proud of this chart,

http://krugman.blogs.nytimes.com/2012/05/03/big-government-and-the-cris…

regards

You left the H out of wingers Steven.......interesting link BTW....Cheers.

hehehe, I was tempted but Im determined to be a good boy......

Oh damn....probably exceeded my 4 posts per day now because of you.....

:P

....oh well....

Oh and it was 2007 as well.........good old HC eh.....a chart over say 20 years would be good actually...might dig a bit.

regards

Krugman has " cherry picked " once again , to support his theories : The chart is only the 5 years , encompassing the GFC , when the big spending governments stimulated their economies out of recession ...

....and as it is , the chart is a shammozzle ........ can you clearly see any patterns there ?

...... a 20 year chart would prove more meaningful , yes .....

Says GBF - our ace cherry-picker. Guess it takes one to know one.

Both are backwards-lookers, never works when the future is different.

http://steadystate.org/new-bretton-woods/

No in 2007 NZ spent as a % of GDP 31%, which actually was what I pointed out, despite the right whiners like you (and you dont live here so dont pay any tax?) saying we spent too much, yet before the GFC we were at 31% about the lowest. The rest looks at the change in GDP over 5 years....so our GDP grew as a point 6%....or 1% per year.

regards

If you are the political right wing you really can't let numbers get in the way of a good theory. This kind of thing would be a threat to an entire species of National/ACT voters. A form of political genocide, if you will.

Damn right on the milk price , you have to ask WTF is going on with Fonterra?

I am told that CLOVER DAIRIES in South Africa which is OWNED BY FONTERRA is selling milk at under NZ0,75 cents per litre to South Africans.

WHY?

We are paying 110% more per litre

We are being screwed by our own people ........ it borders on criminality, Fonterra should never have been allowed to become the monster it has become .

The gouging by Fonterra has got to stop.

We get screwed over much of the time.....our retail market is too small for competition and our sea trade route allows manufacturers to control (mostly) what and how their goods come in, hence the price.

Take a look at say a dewalt 735 planer, $1800NZ here v $550US, spare blades $167NZ v $44US....and the list goes on and on.

and some ppl complain about the taxes Govn collects, private companies gouge far more.

regards

try myus.com to see if you can do some disintermediation

Or maybe see if you can get kogan.com.au to start sending stuff to NZ.

The following is (unreported, but) relevant to #1 and #6 and milk and property.

In the past 2 weeks Qantas has announced the loss of 400 jobs at Tullamarine aiport and the loss of 600 jobs at Laverton Airport (about 80 kms from Tullamarine)

This week saw the closure of First Fleet Tucking company in Melbourne with a loss of 1000 jobs. The managing director accused the two supermarket operators for screwing the life out of the trucking industry. Coles and Woolworths apparently account for 80% of road freight movements in Australia. Coles responded that they have not had a contractual relationship with First Fleet for 5 years.

http://www.theage.com.au/victoria/freight-firm-fails-at-cost-of-1000-jobs-20120503-1y1vd.html

That highlights the fact that Coles and Woolworths are the price-setters and their predatory tactics of pricing down the supply-chain has a cascading effect. They are in control.

This widespread loss of jobs in Melbourne is affecting confidence and is translating into housing price falls in the area of 7% last month. People are nervous.

This also connects to my post earlier this week about property-price-setters landing in Auckland with bucket-loads of instant-cash.

The point is the price-setters don't have to be the direct culprits. They can be indirect.

Yah. The market for project managers is certainly tighter this year in Sydney than last year.

Last year project managers (PM's) were jumping ship for higher offers mid-contract

This year, the likes of Westpac, Telstra and Optus laying off staff has swung the pendulum from a hot market for PMs to a much colder market...

Context. What were they doing? Driving trucks. Or more precisely sitting around waiting for delivery jobs that weren't happening, but, receiving paychecks. What are they doing now? Looking for jobs and experiencing mortgage stress. Not buying properties. Not being upwardly mobile. Not trading up. Probably negotiating with their bankers for a mortgage holiday. Contemplating selling their houses?

Aaaah. You are thinking too logically.

I explained how it is done in this comment on 23 April 2012 12:58 pm

It isn't a slow spiral to the death ... It's ruthless ... It's "Madame Guillotine"

Oh, it's much worse than that ... the following link is merely the latest in a long line of examples of "locals" doing business in china and when it succeeds having it snatched away from them ... there have been a series of them over the past 2 years and have never seen one of them reported in the NZ media

This one popped up yesterday .. the latest one of many ... how it's done

http://www.smh.com.au/world/australian-jailed-in-china-on-murky-charges-20120504-1y3b8.html

This widespread loss of jobs in Melbourne is affecting confidence and is translating into housing price falls in the area of 7% last month. People are nervous.

But but but Your Landlord says increases in unemployment will lead to rising house prices???????????

As Adam Smith once didn't ever say but should have: “Capitalists left to themselves would rather collude than compete”… Got Milk, Got Building Products, Got Food from the Supermarket, Got Petrol… yeah Got it All pretty much got it all stitched up over a cup of coffee in New Zealand… working on trying to outlaw Farmers Markets next. Do you like my BMW SUV meet me at Westhaven on Saturday morning?

What Adam Smith did write in his book 'The Wealth of Nations' was ~

"People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices"

But I'm sure that there are no fellow conspiracy theorists here like Mr Smith...

OMG where is the wording of the petition to be found?

Try this link from the petiononline website

Thanks!

Becoming a NZ speciality ... slacktivisim.

The week's must read piece:

http://ftalphaville.ft.com/blog/2012/05/02/983171/marginal-oil-producti…

And that, dear friends, is why there can be no meaningful economic recovery.........

Too true, I think that's the post of the day for me.

I thought the marginal price was $60 to $80 with Saudi aiming at a "fair price" of $80~85.......I can see that its moved rapidly upwards......now the "fair price" is really $100+ and $120 doesnt look far away....WTI rocking along above $100 now....ho hum......

Seems some might get it (bye bye economy), others think we will adjust,

http://www.youtube.com/watch?v=kdD97m2bnpM&feature=relmfu

regards

winners will “do whatever the rules and ethics allow to maximize their profits.”

And as they fight their way through their third marriage, if they are lucky, it might occur to them to wonder why they need heart medications, why what the world labels success doesn't make them happy and -- for the very few -- a connection may appear between the win at any cost mentality and what that cost is in their wider lives.

Deleted

NZ dollar falling hard ( as of posting that is )

Not quite hard yet OMG......if it clips 76.4 watch the drop ..freefall to 72 if not look to a buy up.

Quit...? ask Fonterra....they're batting 5 n 0 currently....maybe not ...eh.?

Hello Count ! ......the missus has popped down to Coles , so Gummie's nabbed her lap-top ....

........ there was a time when she was my lap-top , happy daze ......

Hey , wotcha take on the $Kiwi .....? ...... seems to me a short term weakness , a reaction to the unemployment figger .....

...... but longer term , she's gonna go back up ? ...... as crunted as the Kiwi economy looks to those who live within it ...... check out the alternatives , such as in the Eurozone ...... those sad feckers , their economies ( Germany excepted ) were worse before the GFC than NZ's is after !

........ sitting outside , enjoying the football on Ray De-O , and onto my 3'rd Coopers " Sparkling Ale "....... life is good , mon ami !

GBH...I think we're about to find out if we really are a commodity based currency...this is where the bullshit gets separated from the the bull semen........leaving invitro out, any rezilliance should be blanks.

Coopers you say....have one for me.!!!

So where's that OCR hike on the horizon? .... market can't see it.

Property investors can be an impatient bunch- short-sighted. If you look at the larger picture, everything returns to the mean, eventually.

Whatever is happening elsewhere in the world, eventually happens here, history shows.

Property is over for a generation-link here

Australian credit growth has collapsed- notice the bounce on the bottom, this is what we face- a return to the mean link here

House prices could continue falling for 20 years, just like Japan- what makes us so special? Are we made of teflon? We might be an island but we are not isolated from world markets, upon which we depend Link here

If you don't have a group of greater fools behind you, ready to pay more for your "asset" than you did, then what is the real value of your asset?

What is the younger generation interested in? Property? Or the latest Ipad? If the latter, then what is your "investment" going to be worth when it comes time to sell?

I don't think we will be seeing any OCR rates, for years, litereally. In fact, we too may see 0% OCR rates in the future, a prediction I made, oh a year and half ago on this site. The Aussie rate was just lowered 50 basis points this week. This was not becuase they care about their borrowers...it's because they care about their banks! Their borrowers, who bought into the concept that property is the greatest "investment" of all time, are now struggling, and as the tide turns, and gutted borrowers realize that they have borrowed too much, they are confronted with having to sell their properties, or give their properties back to the bank, who really doesn't want them.

So the bank's solution is to try to make the mill-stone of debt less heavy, by lowering the interest rate. The principle owed remains the same, never to be repaid, or impossible to re-pay, for so many. In fact, many people are walking zombies, financially, and simply haven't awoken to the fact, but will, if they haven't already. They will head for the exits, soon enough, and hit the "sell" button, over and over.

Multiply this by the number of households in the same situation, too much debt, not enough cash flow, and you realize the scale of the problem these banks face.

We should call it what it is, more than a "crisis," it's a Depression in which we find ourselves. Various financial games have all been played, and tried, in the last Depression, and it didn't work. Things slow down, and stay down, kind of like we are experiencing? Housing starts? Economy? Bouncing on the bottom...continues.

So what do the banks do? They lower the interest rate... to make that millstone of debt more "manageable." It only buys you more time, as more "investors" fall into the same problem, and also head for the exit- selling their property. It's happening here! Only quietly.

Yes, there is a large chunk of the market that is mortgage free, however, that is balanced against those who are completely, 95% leveraged on their debt, and have just lost their job.

Since most of our banks are Aussie, how OZ goes, we go, because we are joined at the hip. Do you really believe that KIwibank and TSB will fill the gap, if ASB, ANZ, BNZ, and Westpac go teats up? Didn't Kiwibank have to borrow money from an Aussie bank to get started?

The concerns of Australia are our concerns: 30% tax on mining starts in July, real estate sales are slowing, and their debt markets are bouncing on the bottom (so they lower interest rates).

Where does the growth come from? China? You are fooling yourself if you believe that! Who are China's biggest customers? That's right- US and Europe- who are both stuck in a hole! The Chinese internal market is good, until about 2015, when it too will turn over, as they retire. The mining boom in OZ only caused a delay in their demographic crash, that started in 2009. Now that their retirees are growing in numbers, there is not the generation behind them to buy all those overpriced houses, no more greater fools.

Bernard's prediction of 30% drop in prices in NZ is fair, because if you blend the value of homes without any debt, with amounts of debt of those who bought in the last 10 years, it probably averages to a 30 lower value than we have now.

House prices are totally dependent on access to cash, and a greater fool who is willing to enslave himself into years of debt. "Mortgage" derived from "Mort," which is French for "death."

Nothing will change until the debt is burned off. Steve Keen will be vindicated, eventually.

I agree with Sinclair, that it will be "QE to infinity" coupled with low wage growth. That means stagflation- lots of it. There are better investments for stagflation than property, especially if you have negative cash flow. That represents a lot of property about to hit the market from investors with negative cash flow- a lot of them mortgagee sales. None of this is good for sustaining prices.

The currency markets are talking about the REMAINING overpriced markets. Do you really think that rents can go up that high, and stay there? It would counter history, wherein, during th elast Depression, rents DECLINED 30%! See this and this

What you have is zombie banks, only not in Japan, but now EVERYWHERE, all refusing to write down their debts, just like Japan for the last 20+ years. However, you should note that the price of a 3 bedroom house today is less than half the price of one 20 YEARS AGO! When you add inflation, this is about as bad of an investment as you can find. Yes, people do need a place to live, but supply and demand always applies- and jobs, and employment, trump property every time. The job market isn't strong, so rents won't go up much, and house prices so out of whack with rents will mean that prices must come down, eventually, to match cash flow.

As Wolly said, classically, "It's a bank owned farm" and we are the feudal sharecroppers.

Happy renter is a oxymoron. Home-owners are truly happy - especially when their mortgages will soon be starting with a 4 (int rate).

If a "happy" renter loses their job they may be on the street quicker than a home owner.

Mortgaget-Belt - no, homeowner and mortgage-payer are the oxymoron.

If they default, the bank re-possesses. If the best offer is $5, the mortgage-payer is anything-but a 'home-owner'.

At least the renter will not be far underwater......

Wouldn't milk at 75 cents a litre be nice for consumers here?

Not so much for farmers though...Time for local prices to reflect global prices?

What are you suggesting by these statements; that farmers are getting paid too much for their milk or supermarkets have too much power in the prices and margins they set? Who has too much power, the farmers or supermarkets?

Fonterra is currently regulated to supply milk to Goodman Fielder and other smaller processors for local consumption. It is also regulated to supply milk to competitor processors who have significant financial investment. How does supplying investor processors regulated milk help the NZ consumer? Does their capital include expertise that we lack?

Bernard do you think like the government and investment community, that by Fonterra shedding it’s cooperative mantle for a corporate through TAF and DIRA, will benefit NZ consumers of milk, provide a ‘much needed investment source’ for NZ capital markets, and allow Fonterra to compete with Nestle in securing milk and processing capacity in developing countries?

If so why does Ha-Joon Chang specifically use the dairy industries of Denmark, Germany and the Netherlands as examples of the importance of cooperatives to economic success?

“23 Things They Don’t Tell You About Capitalism”, by Ha-Joon Chang, Penguin Books 2011. “Furthermore, in rich countries, enterprises cooperate with each other a lot more than do their counterparts in poor countries, even if they operate in similar industries. For example, the dairy sectors in countries such as Denmark, the Netherlands and Germany have become what they are today only because their farmers organised themselves, with state help, into cooperatives and jointly invested in processing facilities and overseas marketing. In contrast, the dairy sectors in the Balkan countries have failed to develop despite quite a large amount of microcredit (investment) channelled into them, because all their dairy farmers tried to make it on their own” (P.166).

On the Euro.I'm in Europe at the moment, it's the day before elections in France and Greece, and I think it is a fair bet that if there is no return to sovereign currencies there will be civil wars.

Ergophobia

So there's merit in investing in what Ergo...small arms manufacturers or anti riot gear makers...or maybe funeral corporates?

Harrrrrrrrrrrrhaahaaahaaaaa....look at this....trust in US institutions...oh what a laugh...three black dots...president...banks...congress.....whatever caused this to happen!

This is quite shocking..unemployed peasants in the USA displaying the sort of fraud and thieving corruption associated with American politicians....dear oh dear!

"Since mid-2010, precisely the time millions of US citizens used up all of their 99 week of unemployment insurance, disability claims have risen by 2.2 million. Those on disability are not counted in the workforce and are not considered unemployed."

The world will be a different one by end of 2012 – even here in New Zealand. Yes- we all must (be) prepare(d) for massive changes.

California proving to be a real hole...

"California’s enduring place of perpetual decline continues in this year’s ranking. Once the most attractive business environment, the Golden State appears to slip deeper into the ninth circle of business hell. The economy, which used to outperform the rest of the country, now substantially underperforms. And its status as the most ruinously contentious place to operate remains undisturbed in eight years. Its unemployment rate, at 10.9 percent, is higher than every other state except Nevada and Rhode Island.

With 12 percent of America’s population, California has one-third of the nation’s welfare recipients. Each year, the evidence that businesses are leaving California or avoid locating there because of the high cost of doing business due to excessive state taxes and stringent regulations, grows"

http://globaleconomicanalysis.blogspot.co.nz/2012/05/california-has-12-of-us-population-33.html

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.