Here's my Top 10 links from around the Internet at midday in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

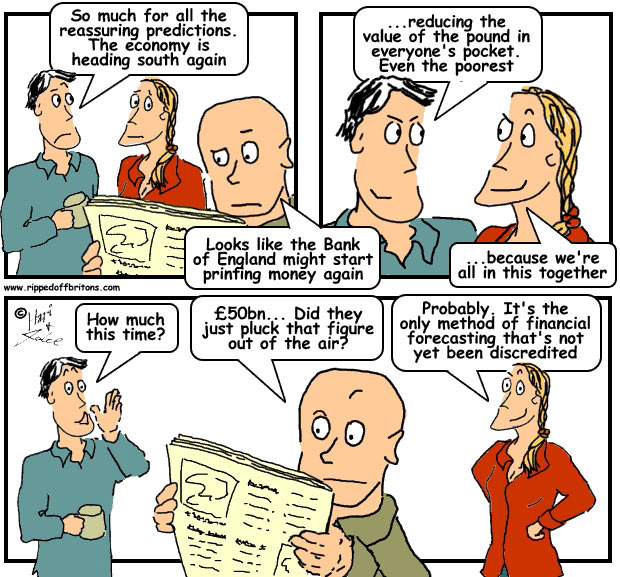

A good crop of cartoons today.

1. Why is John Key so confident about China? - The Wall St Journal reports here that China is loudly telling Europe and the United States that it can't and won't bail them out this time around.

Key spoke this morning about how New Zealand will be OK as long as China stays decoupled from America Europe and the United States.

That can only happen if China goes on yet another monster infrastructure building and real estate development spree to rival the one it undertook through 2009.

That triggered a surge of inflation that China is now desperately trying to control by slowing its economy.

If you want to see a real world indication of how China is being affected by that slowdown -- which is part of the latest 5 year plan by the way -- then have a look at the copper price.

It is down 17% inside the last 10 days. That's a steeper drop than we saw around the Lehman crisis.

Anyway, here's what the Chinese are saying:

"We can't just go save someone," said Gao Xiqing, president of China Investment Corp., China's huge sovereign wealth fund. "We're not saviors. We have to save ourselves," he said at a weekend panel discussion

Chinese central banker Zhou Xiaochuan was just as adamant that China shouldn't be expected to boost its growth rate in an unsustainable fashion to help out the global economy.

Currently China is growing at roughly a 9% annual pace. He said that growth of somewhere between 8% and 10% was a "reasonable expectation."

"Some people may have an irrational hope that the higher the growth, the better," he said at a Saturday news conference. But growth rates of 15% or higher—"that's not realistic," he said.

2. And it's not just the Wall St Journal - Canada's Globe and Mail reports China can't be relied on again to rescue the world.

The country is still dealing with the side effects of its previous stimulus package: burdensome local government debt, stubbornly high inflation and a red-hot housing market that many say is set to blow up.

“I don’t think China will fill the void of growth that is left from a slowdown of the Western economies at this stage,” said Na Liu, the founder of CNC Asset Management and an adviser on China strategy to Scotia Capital. “A new ‘shock and awe’ stimulus package from China like the one in 2008 is almost impossible at this stage.”

At the same time, China’s economy is decelerating from the more than 10 per cent GDP growth it enjoyed in 2010.

A third month of slowdown in manufacturing highlighted by a weak HSBC Chinese purchasing manager’s report this week contributed to the market mayhem that sent global stocks into a tailspin and investors rushing for the safety of bonds.

This little anecdote from a Mr Chen is most interesting:

Many of the factories here that helped the world out of recession are now gone. The low-skill garment factories were the first to go, and now other owners are either shuttering their operations completely or moving to the Chinese interior. As the economy in China has sagged, Mr. Chen’s customers are taking longer and longer to pay for orders, asking for 30-, 60- or even 90-day payment periods, which have hit his cash flow and made him increasingly reliant on loans.

However, since the state-owned banks are refusing loans to small to medium-sized businesses like his own, Mr. Chen says, he has been forced to rely on private lenders with usurious interest rates as high as 60 per cent.

3. The Christchurch effect - Anne Gibson reports at NZHerald on how expectations about the Christchurch rebuild are slowing down building elsewhere.

Christchurch's multi-billion-dollar earthquake rebuild is putting a damper on construction for now as businesses assess the costs of the devastation and staff flock to Canterbury, creating a shortage elsewhere.

A construction sentiment survey from David Langdon, part of AECOM, says uncertainty is dogging the building sector, largely due to the earthquake and ongoing seismic activity.

"Across the country, projects have been cancelled or deferred pending determinations on companies' capital requirements in Christchurch," the survey said.

4. RUB sounds a lot like the MUL - Auckland's new draft plan proposes a Rural Urban Boundary (RUB) to replace its Metropolitan Urban Limit (MUL) and wants Aucklanders to build up rather than out, Jessica Tasman-Jones reports at Stuff. Your view?

But it's not a move all believe will be popular. Professor Jennifer Dixon of Auckland University's planning department said many of the city's high rise apartments, built during the 1990s, have been tarnished by leaky home syndrome.

In an article on the university website this month she said the image of apartment blocks and "cheek-by-jowl" housing does not match New Zealand's long-held dream for a quarter-acre paradise.

5. 'Those greedy boomers' - Paul Sheehan, a Baby boomer, writes at the Sydney Morning Herald that Baby Boomers racked up huge bills and debts that are now coming due.

Responsibility for this bill lies mainly with the boomer-and-bust generation, but the cost will be borne by all.

Though this is a crisis of capitalism and consumerism, it is not caused by the systems themselves, which have been dynamic wealth-generating forces improving the living standards of billions of people to levels not seen before. This is a crisis of consumption and self-absorption, a desire for more than was needed or expected by previous generations. It is a crisis of moral and economic obesity.

6. How a European meltdown would spread to America - John Hussman writes here about the linkages between the stressed European banks and US households, via their money market funds.

He makes a good point too about moral hazard and the hunt for yield. Interest rate repression by central banks drives all sorts of desperate behaviour.

According to Fitch Ratings, the ten largest U.S. prime money market funds had total assets of $658 billion as of July 31, 2011. Of those assets, $309 billion - an unsettling 47% of the total - represented debt obligations issued by European banks. It is unclear what level of subordination these debt obligations take, but we can expect that in the event of a Greek default, this concentrated ownership of European bank debt by U.S. money market funds will be less than ideal for investor confidence.

I can't imagine what the yield-reaching managers holding European bank debt are thinking, but if last week's agreement by the Fed to provide dollar swaps to the ECB is any indication, my guess is that the eagerness to send dollar liquidity to Europe is abruptly drying up from private sources. In any case, the heavy allocation of U.S. savings to the European banking system strikes me as an awful example of "moral hazard" produced by two forces: the 2008-2009 bank bailouts, coupled with a European regulatory structure that doesn't require those banks to hold any capital against holdings of European government debt, including that of Greece.

As we saw in the housing crisis, when a weak regulatory structure encourages unaccountable leverage, and irresponsible monetary policies encourage reaching for yield, the combined result is predictably disastrous.

7. China's trusts - This piece via BusinessWeek goes into a bit more depth on the extent of the off-balance sheet and unregulated trust lending sector in China. These trusts sound an awful lot like our finance companies.

As the official banks have cracked down on lending, many of the developers and local government vehicles have migrated to the unregulated trusts who make short term loans at rates of 10-30%...

In my view they're the sort of things you reach for at the final stages of a bubble to prop up a Ponzi scheme...

China’s banking regulator is looking into financing of developers through trust companies as part of a broader evaluation of real estate lending, a person familiar with the matter said.Chinese property developers led by Greentown China Holdings Ltd. plunged in Hong Kong trading yesterday on concern tightened access to loans will force them to cut prices.

“Given that the nature of trust loans is short term, the key question would be whether or not developers have sufficient cash to repay the outstanding loan amounts,” Samsung Securities Asia Ltd. analysts led by Wee Liat Lee, said in a report today. “We believe that developers should be financially secure should the trust loans not to be rolled over.”

Trust loans are usually debt that’s repackaged into investment products and sold to retail investors, and the loans are typically funded by banks or the investors themselves, according to Samsung Securities. For most developers, these make up less than 10 percent of their loans and the debt maturity is a few months to a year, the brokerage said, adding that the interest rate ranges from 10 percent to 30 percent.

8. So what happens next? - Australian hedge fund manager John Hempton muses at Bronte Capital about what might happen with Greece and the euro.

He sees either a default and an exit from the euro or a default and no exit. Neither ends well. The former is very bad.

Here's his thinking, which hinges on a Greek default and surprise devaluation causing chaos in the rest of the PIGS:

A bank deposit in Athens is going to turn your Euros into Drachma. Overnight it will lose 70 percent of its valuation. So it has to be done quickly and with an element of surprise (as per Argentina when most people did not get their dollars over the border). Without surprise people will rush their money to Deutsche Bank in Munich.

One weekend we will just find that the Greeks have done it.

But now suppose Greece does pull this trick. The day after we have a Drachma - deposits are in Drachma. We might print a single 10 drachma note and allow it to settle against the Euro - then over time print more. This should work for Greece.

Now if you are Irish or Italian or Portuguese (or even Spanish) you know the rules. You get to get your Euro out of the PIGS and into the core (Germany) as fast as possible. So max all your credit cards (for cash), draw all your bank deposits and load them in the boot of your car and make the drive to Switzerland or Germany. Somewhere safe. Otherwise you are going to lose half the value the day that the rest of the PIGS do a Greece.

And this bank run – a run including tens of thousands of Italians driving their Fiats - will surely blow apart every Italian bank. And their Euro-skeloritic compatriots will sign the death knell for for all their banks too.

9. Save the rich from themselves - Yves Smith at Naked Capitalism has pointed to an excellent post by The London Banker that cites testimony by Marriner Eccles to the Senate Finance Committee in 1993 on how to save the rich from themselves.

It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving. They can save idle factories and useless railroad coaches; they can save empty office buildings and closed banks; they can save paper evidences of foreign loans; but as a class they can not save anything that is worth saving, above and beyond the amount that is made profitable by the increase of consumer buying.

It is for the interests of the well to do – to protect them from the results of their own folly – that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit. This is not “soaking the rich”; it is saving the rich. Incidentally, it is the only way to assure them the serenity and security which they do not have at the present moment.

10. Totally Jon Stewart on Barack Obama's tax plan.

39 Comments

"We're doomed Mr Mainwaring, doomed"

PM - in 2012 the world will be and looks so much different.

Again politicians/ policymakers are not taking the entire world picture into consideration making statements, especially in election years they make flattering statements - lying to their citizens.

While negative financial head lines dominate the news today, there is something much more dangers occurring - sable rattling, especially in the

Middle East. The world power is certainly shifting, but without its difficulties. Next to turmoil on economic/ financial fronts leading to internal problems of most western countries - political tension is growing and as a consequence military expenses will increase sharply – but where does the money come from to pay – the West the losers - end of societies as we know it ?

Listen to 10 - what a salad of words by Obama

PM – here an interesting, but simple description to learn and understand the bizarre flow of money for the next few years and a confirmation, how wrong you are with your prediction - again.

http://www.worldthinktank.net/pdfs/TheFlowofMoney AllegoryBeachBall.pdf

I get so sick of bankers and politicians saying "we've got to inject more money and do it now!" Let the bankers inject their own money and keep their stinking mitts of my kids' future.

Nicely put, bravo

Key spoke this morning about how New Zealand will be OK as long as China stays decoupled from America and the United States.

from America and the United States

?

Europe and United States?

regards

#1 - Easy solution for Communist China not to need to 'bail us out' again!

float your currency, import things other than raw materials, & stop destorying the productive sectors or everybody elses economies.

1) Why should they float and take pain when we in the west have buggered ourselves?

2) They are one of the worlds few growing markets for luxury German cars....

3) This is consumer choice, and CEO choice........both choose to buy made in china and manufacture there.

regards

2) They are one of the worlds few growing markets for luxury German cars..

and shark fins !!!

And Rhino horn (preferably ground)

I think you will find that the CEO choice came before the consumers were left with little choice following the offshoring of their jobs, and the importing of illegal immigrants !

#1...maybe they are going to lend a shipload of Yuan to Australasia so we can have an entertainment center in every room of the house...the renter...the other renter...the other other renter...the o.......

no..... not going to work is it....! What China needs to do ironically... is get the U.S. back to work.

#9 - that's 1933 - not 1993.

Where was our Navy off to this morning? Perhaps headed to Wellington for the Pool A games in the weekend? Or maybe off the Sydney for the Grand Final?

I understand scarfie, they got a solid line on where Franks hiding.....apparently he's hole up at Parliment bldg Fiji with a 57" plasma..and a box of Kleenex...

Key felt while Frankie's down in the dumps somebody oughta take him out.

Remember that it's usually a small unpredicable event that kicks it all off.....rodney king and the LA riots, or most recently when the tunisian set himself on fire it started the "arab spring" .... the same thing could happen at the #occupywallstreet protests in the states....and the same could happen re the parlous financial state of the world.

remember the old Chinese curse "may you live in interesting times"?

everything is in place. who will bring the lighter?

That would be...Jack be Nimble...of course Vanderlei....in his flanelette P.J.'s tempting fate with each pass till.... Great Balls Afire ...starts ringing out in Bmaj.

They had protests down Wall St just the other day. Police beat the crap out of people just for being there. Go to Huff Po & watch. The US is a police state already, has been for a while I'd say. They criticize Iran etc but you try peacefully yelling and hollering in NY or Washington with your sign and see what happens.

The US authorities are ready for any descent in coming years believe me. Homeland Security had a "martial law" readiness test the other week.

The bank runs in the piigs will be cut off at the door with regulations restricting withdrawls to token sums and automatic payments already set up. Only fools will await the Greek default. Bankers and other shites will have moved out of euro long ago.

Has English announced his deposit guarantees yet?

It took bad thinking and bad policy by many players to get us into the state we’re in; rarely in the course of human events have so many worked so hard to do so much damage.

LOL

http://krugman.blogs.nytimes.com/2011/09/23/eurovillains/

or maybe I should be wailing.......

One thing I do like about the Liberatarian point of view is when you f*ck up you take the can.....but this has got beyond a joke when others f*ck up and you take the can anyway....

regards

The Emperor gets his clothes back...Ostrich....being seen as the dominant is still of utmost importance despite the lack of suitable attire.

What a fabulous farce...european liars plan to use credit and leverage to solve a problem caused by too much credit and leverage....why am I not surprised. I just wish I could sell tickets to this live show of idiocy and greed.

"Take a seat folks...there will be many short breaks for a pee...keep an eye out for the arrival of the Bull Elephants as they stampede through the tent...the swine elected to run the circus have promised you won't feel a thing."

And those who rush the exits discover they lead into yet more variations on the big flop they ran from and the sound of the charging Elephants is getting louder LOUDER....the ground is starting to shake.

"About 300 students have occupied the 6th floor of a building at Auckland University" herald

Well I never..I spose they must have rediscovered their need for qualifications and picked this lecture as the most promising...!

.. meebee the cafeteria got shifted up there ?

#4

It is over to residents groups to ensure that "growth (really is) good" and not just good for the realestate and associated industries. The usual measures of what is good ignore externalites and the sort of "best places to live" reports are for bankers on transfer".

Does anybody actually understand the point that is being made in the extract at #9?

This quote from Richard Hienberg [The End of Growth] provoke an extremely derisoury response on Kiwiblog. It would be i nteresting to know how our politicians and business leaders feel:

The ideological clash between Keynesians and neoliberals (represented to a certain degree in the escalating all-out warfare between the U.S. Democratic and Republican political parties) will no doubt continue and even intensify. But the ensuing heat of battle will yield little light if both philosophies conceal the same fundamental errors. One such error is of course the belief that economies can and should perpetually grow.

But that error rests on another that is deeper and subtler. The subsuming of land within the category of capital by nearly all post-classical economists had amounted to a declaration that Nature is merely a subset of the human economy—an endless pile of resources to be transformed into wealth. It also meant that natural resources could always be substituted with some other form of capital—money or technology. The reality, of course, is that the human economy exists within, and entirely depends upon Nature, and many natural resources have no realistic substitutes. This fundamental logical and philosophical mistake, embedded at the very heart of modern mainstream economic philosophies, set society directly upon a course toward the current era of climate change and resource depletion, and its persistence makes conventional economic theories—of both Keynesian and neoliberal varieties—utterly incapable of dealing with the economic and environmental survival threats to civilization in the 21st century.

http://richardheinberg.com/221-economics-for-the-hurried

Re 1

Currently China is growing at roughly a 9% annual pace. He said that growth of somewhere between 8% and 10% was a "reasonable expectation."

I've lost track of the number of times I've said here, but;

All growth is expressed in terms of 'doubling time'. They all double, and double, and double that again.

All growth rates are, therefore, long-term unsustainable.

The only variable is time.

Is it that the vast majority of cranial evolution got wired up to think in linear fashion? Is it so hard the grasp?

The guy is talking horseshit. Mathematical horseshit. Why do so many listen to this nonsense? Report it unchallenged?

Top 15 countries for internet speed are:

http://www.huffingtonpost.com/2011/09/24/fastest-internet-speed-pando-a…

Guess who ain't on the list?

Some serious protesting at Wall Street. We need some of that here.

How's that gold position you took on a few weeks back scarfie...?....wish I could find my response to you at the time.

Cash bucko...cold hard casharoonie (even the debased stuff).....watch for a bull run of mortgagee sales coming up before xmas...

The train it wont stop going ....no way to slow down..

I haven't done the calcs, but still about even with the drop in the NZD. I am not too worried as I see it being a long term position. I think land won't be at a satisfactory price for a year or two yet. Heck even with a few mortgagee sales the spruikers will still hold the prices up, the point I will be looking for is when there are no spruikers left. When there are no bids, that is getting toward the bottom:)

I have to say the manipulation is a worry though, and I expect there will be a few more hiccups along the way. I look to the troubles in Europe for peace of mind.

There were some interesting articles about in the weekend, but still hard to say which way it will go short term, but I think in NZD terms it will be okay. Once we see a bank failure in Europe then I don't think any manipulation will hold the PM's back. I notice that the graphs of all commodities look the same as gold so hopefully there will be some divergence at some point.

But I still have cash also Count.

As one commentator pointed out, the people selling guns won't be taking cash.......

Glad to hear it scarfie and as andyh points out as the N.Z. slides it will improve or stabilize your position...

Go well.!

Well, if, as I imagine, he bought gold with NZ$ I would think his position is just fine, as the NZ$ has come off 10% plus.

Gold, priced in NZ$, went up to $2300 or thereabouts - its now @ NZ$2080, a fall of around $NZ200, (about 9%). Considering in its August/Sept rally it moved from $NZ 1880 to $NZ2300 (a move of 25%plus) I rather think he is not to concerned.

Buying gold when the NZ$ is >0.78c to the US$ brings currency protection that few consider.

Just checked and it was at $1975 NZD when I jumped in:) Gee I have just checked the chart, and that long tail on the daily is ominous.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.