Here's my Top 10 links from around the Internet at 4 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Fran O'Sullivan's column is well worth reading.

1, Global economic marital disharmony - PIMCO Boss Bill Gross is the biggest bond fund investor in the world.

He has hundreds of analysts digging stuff up for him that isn't biased in favour of some investment bank's proprietary trading book or some politicians' voting prospects.

You could argue that he is just talking his US$1.3 trillion book of bonds. But at least you know where you stand.

His monthly missives are always worth a read.

This month he points out the rampant demand for bonds is a product of a deep disillusion with the prospects for growth given the disharmony between policy makers globally.

Here's his thinking, along with a cracking chart.

He also points out he likes non-US dollar assets with exposure to Asian growth. That, of course, includes us, and might explain why our currency is well over 85 USc less than six months after the worst natural disaster to hit a developed economy (in % of GDP) in over a century.

During the US’s recent economic “recovery,” real corporate profits increased by four times the amount of working wages in dollar terms, and, as the chart below shows, are 50% higher than at the turn of the century while wages remain relatively unchanged, something that has not occurred since this country’s nuptials were concluded over three centuries ago. Is it any wonder that preliminary battlefield skirmishes in Wisconsin and Ohio between labor and capital promise to spread across every state of this land? (Not Texas!) Is it any wonder that Republican orthodoxies favoring tax cuts for the rich and Democratic orthodoxies promoting entitlements for the poor threaten to hamstring any constructive efforts to reduce unemployment over the foreseeable future? We are witnessing romantic love turning into a spiteful, bitter clash between partners in name only.

China, meanwhile, calmly played its cards with a decades-long plan centered around capitalistic mercantilism, a game the United States claimed to play best but somehow forgot most of the rules. Even when holding the trump card of a reserve currency, mercantilistic domination depends on making something the rest of the world wants. We don’t and they do. The Chinese “object” has turned into an object lesson for developed economies that debt-financed consumerism is reaching an end. This affair then, which has sustained global growth during much of the 21st century, is vulnerable.

In the U.S., strangely enough, matrimonial discord between rich and poor has led to lower, not higher, Treasury yields as approaching recessionary winds force the Fed and private investors to favor bonds. There are limits, however. Ten-year Treasuries at 2.25% are discounting a heap of trouble (none of it strangely enough due to its own credit standing), and neither investor nor borrower may emerge from this brouhaha unscathed. We prefer the “cleaner” dirty shirt countries of Canada, Australia, Mexico and Brazil, where higher yields and more pristine balance sheets prevail.

2. Two days to sort it out - The latest comments from various FOMC members over the last couple of days and from the last meeting minutes show the US Federal Reserve's main policy making committee is deeply dvided over the need for more money printing.

Some want much more.

Some think the pledge to keep the Fed Funds Rate at 0% for two more years is already too much stimulus.

No wonder Ben Bernanke needs an extra day at next month's meeting (September 20-21)to convince them to do something.

Anything.

Here's Reuters on the Fed's divisions:

Two top Federal Reserve officials diverged on Tuesday on the need for further action by the central bank to stimulate the flagging economic recovery, underscoring the dilemma faced by Fed Chairman Ben Bernanke.

Charles Evans, president of the Chicago Federal Reserve Bank and a noted policy dove, said he favored strong central bank accommodation "for a substantial period of time," since the economy now looks to be moving "sideways."

But Naryana Kocherlakota, president of the Minneapolis Federal Reserve Bank, speaking separately on Tuesday, stopped well short of signaling support for further easing, showing he remains firmly on the hawkish wing of the Fed's policy-setting panel.

3. Good to see - The consensus about unfettered free trade in Australia is breaking down, Bernard Keane reports at Crikey.

It's good to see the issue of free trade being debated. Frankly, it hasn't worked for the middle classes of the developed world. They got cheap stuff, but lost their jobs.

Their wealth was transferred to the richest as much of the the lower manufacturing costs in China were captured as profits. The middle classes kept spending as if nothing had changed, but only could do so by borrowing from the trade surplus countries such as China and Germany.

The Chinese and Germans preached free trade but acted like mercantilists, keeping their currencies low to bolster their export sectors and build up big foreign reserves.

Let's face it. Free trade works best for mercantilists. We have to acknowledge the world is not free and fair.

It seems cynical and sad, but in the end you have to fight for your national interest and avoid the sort of social disruption we're now seeing. Otherwise you end up with a very, very rich elite running and owning these multinationals, an unemployed (mostly young) middle class and an increasingly indebted group of developed economies.

It's not sustainable and creates the sort of capital imbalances and financial market volatility that is ultimately self-destructive.

Here's Crikey (who is obviously still a beliver in the flat earth of free trade):

The successful economic reform project of the last 30 years stands at an important juncture. A key component, free trade, is under increasing pressure from organized labour, the balance of power party and conservatives, and all that stands in the way is a minority government.

Now there’s a clear push for manufacturing protectionism from Sophie Mirabella, who while – like everyone else – is unwilling to cop to the protectionist label, is talking the crudest kind of protectionist rhetoric about “playing fields not being level” and “subsidized goods distorting our markets” (“our” being the key emotive word).

4. Bank profits to fall - Uber-consultants McKinsey reckon US bank returns on equity will drop to 7% from around 20% because of new regulation. I hope our Reserve Bank is watching and ready to do the same here.

Bank ROEs are headed back towards the high teens here again. That is way too high for utility businesses.

Returns at top banks will shrink two thirds unless they take action to limit fallout from tougherregulation, consultancy McKinsey said on Wednesday.

"In some businesses, a portion of the higher regulatory costs may successfully be passed on to customers," it said in a report into the world's top 13 lenders.

Based on 2010 data, the average return on equity (ROE) -- a key profitability benchmark -- was about 20 percent.

That will be slashed to about 7 percent by the introduction of tougher global bank capital and liquidity standards, known as Basel III and due in stages from 2013, coupled with other rules such as mandatory clearing of derivatives contracts.

5. Fran unloads - Fran O'Sullivan has written a strong column in the NZHerald arguing for government action on the earthquake and the economy, including a tax on the rich to replenish the natural disaster fund that has just been cleaned out.

Why hasn't the National Government urgently launched a three-point action programme to deal with the serious risks to the economy resulting from the major earthquakes in Canterbury?

The Canterbury quakes are proving to have a much more significant impact on this country than the global financial crisis which sparked the Key Government's launch of a "rolling maul" of initiatives. How hard would it be for the Government to:

* Immediately impose a special tax aimed at higher income earners to start replenishing the Natural Disaster Fund which has been exhausted by the impact of the Christchurch quakes.

* Commandeer large amounts of stable land on the outskirts of Christchurch and launch a big state-led building programme to get people safely rehoused quickly. Do this instead of allowing developers to book obscene profits at the expense of fellow citizens who have already lost enough of their equity through the quakes.

* Tell New Zealanders - including the business community - the truth about just what it will cost in future to insure residential and commercial buildings in this seismically challenged land.

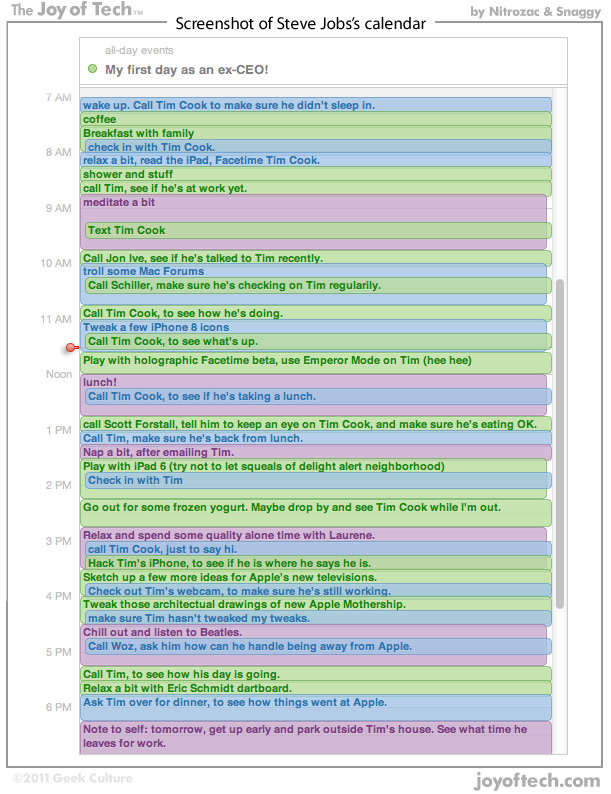

Despite accumulating an estimated $8.3 billion fortune through his holdings in Appleand a 7.4 percent stake inDisney (through the sale of Pixar), there is no public record of Mr. Jobs giving money to charity.

Mr. Jobs’s views on charity are unclear since he rarely talks about it. But in 1997, when Mr. Jobs returned to Apple, he closed the company’s philanthropic programs. At the time, he said he wanted to restore the company’s profitability. Despite the company’s $14 billion in profits last year and its $76 billion cash pile today, the giving programs have never been reinstated.

9 'Dear Ben, please print us some more money' - Testosterone Pit at Zerohedge asks Ben Bernanke for more money printing and inflation. The tongue is firmly in cheek, but the point is serious.

Real wages have been declining for ten years and fell another 1.7% since July 2010. But that's not enough. So get with it, Ben. Print more. And don't worry about the wusses out there who say that choking the middle class like that will put us into a permanent recession. Just get the banks to loan them lots of money so they can buy our stuff, and when the loans blow up, you buy them from the banks at face value. Full circle, Ben.

The trillions you've printed and handed to us, well, we put them to work, and we created jobs in China and Mexico and Germany, and we bought assets, and it inflated prices, and now we're even richer. We're proud of you, Ben. Think of the influence you have. And not just here. Around the world, Ben! Look at the Middle East and North Africa. See the food riots, rebellions, and civil wars it caused? Thousands of people died and entire governments were toppled.... Oh, wait. That's a bad example.

And then there is Congress. We invested in them through campaign contributions and other mechanisms to get them to spend trillions of dollars every year on our products and services, and they even started a few wars, and it made us richer—without taxing our companies or us. It's a wonderful system.

But the deficits have become so huge that they exceed what the Treasury can borrow. So we're glad, Ben, that you stepped up to the plate and printed enough money to monetize the deficit. But Ben, you can't just stop now! You've got to keep at it. Or else, the whole system will blow up. Well, it'll blow up anyway, but we don't want it to blow up now. So, Ben, you don't have a choice. Otherwise, we'd lose a lot of money in our schemes, and nobody wants that.

10. Totally The Daily Show on the Republican Party

83 Comments

Re (5) Fran O'Sullivan's Road to my Serfdom.

And NotPC gives Fran a lesson on economics.

I wish all these MSM Big Statists coming out of the woodwork would get on the bikes and go away.

Tribeless,

I quite like my bike. It's fast, clean, cheap and doesn't generate any greenhouse gases...

How's that laissez faire thing going for you and the world?

Working ok?

cheers

Bernard

You just dont understand Bernard - it just wasn't laissez faire ENOUGH! If there hadnt been ANY regulation NONE OF THIS WOULD HAVE HAPPENED!!!!!

It ok BH just suffering from value attribution, diagnostic bias and label bias to support his initial judgements..he is human...

hehehehe...funny but the hard core socialists said that in the 60s and 70s....after 30 years of more and more laizzez faire we are at the same (or actually a bigger )mess but then you cannot argue with fundies/fanatics of either camp.

regards

Show me anywhere in the world laissez faire is operating Bernard? And don't tell me Somalia.

Tribeless,

I'm actually sympathetic on the view that if we had truly free markets everywhere with perfect information where monopolies were not allowed to form then we would be better off.

The trouble is companies and politicians (which actually means humans) understand that gaining a monopoly and exercising market power by blocking such free markets and information flows is the best way to make themselves richer and more powerful.

There is no such thing as a truly free market. There never will be while humans are in charge. You have to assume that absolute power corrupts both the politicians and the CEOs and legislate to protect consumers and workers. That means creating institutions and laws to stop the very powerful distorting markets and information flows to benefit themselves.

Hence the role of regulators and democratic government.

I certainly agree the US banks should have been allowed to fall over (or at least wipe out the shareholders first and then bond holders before deposit holders).

But ever since the days of the robber barons and the trusts of the early 1900s capitalists have proven they don't really believe in free markets.

cheers

Bernard

So, it's not the free market that's the problem, it's the corrupt political and democratic system that is the real issue. Take it further and the problem is the dumbed down population that have allowed it to happen.

Any system designed by humans will always be intrinsically flawed. It's more of a question of how flawed...

Just look at our poor troubled Capital Markets. Now if you say capital markets I guess you are talking about Capitalists. It seems that Our Capital Markets are in trouble. Oh dear. So instead of letting the market operate and the NZX go down the tubes, our right wing socialist National government of New Zealand has decided that the rest of us have to give up our rights to our own hydro power and hand it over to our capital markets to save them. I guess every little bit helps.

I see, black and white again.....typical fundie/fanatic point of view. So its OK for you as a fringe fundie libertarian with all of 1000 supporters in NZ to tell the rest of the country it is wrong and take a hike.....

Doesnt work...

regards

Are you really this stupid steven?

The classical liberal society is one where I cannot tell you what to do or how you live your life, so long as you don't initiate force on me. That's called freedom. Compare that to how our current society works solely through State coercion, and your rule over me through the tyranny of the majority in this social(alist) democracy of New Zealand.

It's quite simple. And how many people believe in a thing has no bearing on it's truthfulness; otherwise burgers from McDonalds would actually taste good. They don't.

"The most strident business advocates of market fundamentalism made clear that the principle of survival of the fittest had never been intended to apply to them. Government support for free markets meant government support of markets. If they seized up, the responsibility of government was to support these markets by providing the liquidity that would enable them to trade freely. In this intellectual milieu the notion of putting a $700bn slush fund for failed businesses at the discretion of a Secretary of the US Treasury who was himself the former CEO of the largest investment bank, seemed entirely natural and coherent. It is difficult to exaggerate the sense of entitlement felt, and still felt, in the City of London and on Wall Street."

"And so financial institutions in general, and investment banks in particular, became the most powerful industrial lobbies in the western world. Simon Johnson has drawn the analogy between Wall Street and the Russian oligarchs—or mediaeval barons—who operated in a self-reinforcing style in which political power enhanced economic power and vice versa. It is, he suggests, a cycle capable of being broken only by revolution or external intervention."

http://www.johnkay.com/2011/08/30/a-good-crisis-gone-to-waste

Glad to see refernce to John Kay , a great read every Wednesday in the FT

It was broken last time by the Great Depression....so via the ballot box....Im hopeful it will be borken again by the same method. Trouble is Labour (or someone else) have to wake up to that.....so another term in opposition for them is actually the best way....it might make them wake up.

Meanwhile National will spend 3 years beating that the recovery they promised and didnt deliver on, wasnt their fault.....or today Labour have to gamble hugely....tell it like it is...."we are f*cked we will raise the top tax rate to 40% and have a CGT and Land tax to balance the books...and campaign on that, they are screwwed anyway.......its NZ's last chance and their last chance.....this time around...go for it Goff....death or glory, lead with insight....your a dead man anyway.

Oh and Les lets not forget that business leaders were all for lower taxes....sorry but without saving for a rainy day and by setting a tax system that balances only in a growth situation they have signed their own bankruptcy papers....I dont feel sorry for them.....their workers, sure.

regards

steven - indeed, some, "business leaders are all for lower taxes" but will never suggest taxing land, property, capital and gains. Then there are others who suggest reducing (and also unifying rates of) taxes by broadening the system to more effectively include land, property, capital and gains . You will find fewer real economy people in the first group and more in the second. Not all business leaders are in the same business, not all are in the FIRE and domestic sector, not all think the same, For something different to the usual stance of the NACT, FF and Business NZ axis, that you seem to be referring to, you know where to go:

Cheers, Les.

No its still a right of centre wing rant...

regards

But if Phil Goff said it, do you think he would get more or less support back from right of centre?

.... the speech suggests Kiwis stop using the government & welfare as an ATM . And that we should get more money into the pockets of all New Zealanders , not just Jolly Kid's rich mates . That we should recognise that employment is increasingly grown in small firms and private contractors , rather than in large enterprises .....

Whew !... Really right-wing-whacko stuff that ..... little wonder that neither Labour nor National would have a bar of that speech ... Terrible stuff , terrible .

Thanks for your support Roger. I gave you a tick. I would have given you more ticks, but, looks like Bernard doesn't like two-tick types.

.. you're welcome , Les .

Personally , Bernard thinks that I'm an annoying little tick . He's ticked off at us ' rabid right of centre " types who still believe in private enterprise , thrift & innovation ...... Tick !

#10 A good article from Paul Krugman worried about how anti-science the Republican Party is. http://www.nytimes.com/2011/08/29/opinion/republicans-against-science.html?ref=paulkrugman

Um, is that the same Paul Krugman who thought the destruction wrough by Irene would be a good stimulus to the US economy?

Yeah right.

Um I read most of what Krugman publishes and can't recall him ever saying this. Have you got a source you can quote?

"Update: If you think I believe that disaster is good for its own sake, you have drunk the Kool-aid."

http://krugman.blogs.nytimes.com/2011/08/24/fake-me/

Expecting you as a fundie Libertarian to quote PK in context and correctly is like expecting a turkey to vote for Xmas, its extremely unlikely.

Happy to lie about / smear the opposition comes to mind......Or of course you could be easily gullable, because you want to be.

http://krugman.blogs.nytimes.com/2011/08/24/identity-theft/

"So if you see me quoted as saying something really stupid or outrageous, and it didn’t come from the Times or some other verifiable site, you should probably assume it was a fake."

Now if this was a one off I could accept gullable.....but I dont consider you stupid....

regards

Not just anti-science, but anti-data, anti-economics....anti-anything that doesnt feel right....

regards

(3) Bernard could you please explain how the Germans keep their currency low?

Or are you seroiusly suggesting they continue to remain members of the Euro mess to these ends.

Colin,

Exactly. German interest rates and the mark would be much higher if Germany wasn't in the euro zone.

Germany wouldn't be running the big current account surplus it is if it still had the mark.

Many believe that's the reason why it will fight to keep the euro. The euro zone is designed to make it easy for German exporters to sell cheaply to southern European importers, and then lend them the money to keep buying the German imports.

It's very similar to the Chinese.

cheers

Bernard

Come on Bernard Germany is one of originators of the Euro being there during good times and bad. They have carried out substantial reforms to their economy and have become very productive producers of high value products. The fact the Euro has been dragged down by the Euro mess has simply put the icing on the cake for what has turned out to a relatively short lived boom very convenient however but your suggestion is one step too far.

I'm not the only saying German exporters benefit from being in the Euro.

The mark would be much stronger than the euro. No question. The Bundesbank wouldn't be printing money and buying dodgy Italian and Spanish bonds.

cheers

Bernard

Thats a pretty conclusive downward trend establishing itself in the Aussie housemarket.

I wonder what the government there will think of next to try and save the day? Another $7000 first home buyers credit? Its ironic that many of the folk who jumped in off the back of that credit will now be seeing their houses regress in price somewhat more than the $7000 bait, chuckle.

Another buyers credit, yes probably, but its now probably too late for that...

Ironic, yes those poor ppl will be screwed over with years if not decades of negative equity (or even bankruptcy) and the problem/responsibility is clearly that of the Govn...thank god we didnt do it here....

regards

From Fran O'Sullivan on the earthquake

"Commandeer large amounts of stable land on the outskirts of Christchurch and launch a big state-led building programme to get people safely rehoused quickly. Do this instead of allowing developers to book obscene profits at the expense of fellow citizens who have already lost enough of their equity through the quakes".

Its far more serious than developers making a profit thousands of home owners in the red zone simply have no way of being able to afford current section prices. Many will simply be forced to leave. One only needs to read the local of their despair. This situation is a totally disgrace the CHCH City Council will not step up to the plate just the opposite.

I've heard it argued that we get the politicians that we deserve.

In which case everyone in NZ must be a sadistic, abusive, self loathing, no-good loser.

Not me Andy, but then I don't vote:)

Yeah, trick is not to vote, never put your name on the "exploit me" roll

Dear Fran,

Don't suppose you know that most high income earners earn high incomes because they work bloody long and bloody hard. Your proposed tax is noble indeed but must be applied to all taxpayers. If we as a society must have the inequality you aspire to, the laziest taxpayers should pay more. What say you now?

Regards

FYI

I am constantly astounded at how people can equate lazy to low income. I hope you don't need a paramedic, nurse, policeman or teacher anytime soon. Ever worked rotating shifts?

So by your reasoning if an excutive earns $200K per year then he must be working 4x as many hours as the nurse, or 160 hours per week.

...or my immigrant neighbour who works at a local factory loading pallets, and who I reckon must sweat the equivalent of a 40 gallon drum and run a couple of marathons every day...

The occupations you mention all earn well in excess of 50k when experienced...many are in the top tax braket actually...possibly bad examples...

I don't think that it is too far off, perhaps $60K would catch 90% or more of those professions. Those on more don't necessarily work any longer or harder either.

I use those examples because they are professions that require tertiary training and that you would expect to earn a decent salary. I also use them because most would work pretty damn hard for their money, particularly the shift workers. I would include firemen, but they sleep half the job away:-p

I think everyone would get a bloody shock..... if they could see the salary scales for the Sir Humphreys.

Nevermind their salaries, I'd rather see how many of the influencial types are invested heavily in property. It's probably not just approx. 60% of parliamentarians who have a potential conflict of interest on the topic of property taxation, but influencial offcials as well - maybe.

Scarfie,

You missed the point mate.

Low income earners are not necessarily lazy, high income earners are not necessarily the hardest working. My suggestion is, in a perfect world, the fairest system possible would direct that the laziest taxpayers should pay a higher percentage of their income than the harder working ones.

Imagine yourself stuck on a desert island with 20 people. Some would be lazy, some wouldn't. Which is more likely (and more deserving) to survive?

It's not about rich versus poor. It's about what's fair and what's not.

Oh got your point alright, but most won't get mine. Probably not a good forum for this sort of discusstion, but I wonder if your type of thinking, or absence of it, is what has got us into the mess we are facing. I mean define lazy?

I think you might confuse inactivity with laziness, and insome cases you may be right.

But there are plenty that have recognised the current political and econimic systems are leading the greater proportion of the population to servitude. Perhaps if others spent a little more time thinking eh?

What if one of those lazy ones on the desert island really did do bugger all, but was the one to invent a way of distilling drinking water from sea water. He might also be the one to work out signaling systems to enable rescue.

Different personalities and modes of operation. Am I getting the picture across?

Absolute b*llocks is what I say. There is no link to working hard and compensation and actually there seems to be some evidence that it (bonuses in particular) is counter-productive. Also high "income" earners like the super rich actually get all of tehir gain from capital gain and not PAYE so avoid tax......simple tax them at 30% with a CGT thats a good start.

regards

And these CEO's must work really hard and really long 24/7.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10748714

The cost of the earthquake is big for sure but its peanuts compared to the every increasing cost to our economy of importing oil. $10 billion extra per year by 2015 according to these calculations . Thats the cost of the earthquake each and every year. $19 Billion per year by 2020.

I will take Fran O'Sullivan and other business journos seriously when they start to report on this massive threat to our economy and hold all the main parties to account for failing to act to reduce our dependence on imported oil. (I don't mean drill and hope gambles which even if oil is found here will not impact the price we pay here)

Consumption of Oil Imports. That is one of the most powerful reasons why New Zealand has to curb immigration. Alternatively every migrant arriving in the country should be required to put up a bond or deposit of $5000 pa for every year of the expected duration of their stay in the country. At the expiration of each year $5000 is taken out into the consolidated revenue for the oil and petrol they will consume. A migrant arriving at age 20 with a life expectancy of 50 years should put up a bond of $250,000. Otherwise New Zealand will have to work the treadmill faster and pull on the cows teat that much harder. If they leave the country they can have the un-consumed remainder of their account back.

Over the years I've read some pretty weird shit on this site , and I've written a fair swathe of it myself .......... but you're in a class of your own , mate .

.... Far out ! ...... so freaking far out that NASA would never find yer ......

Merci Mr Bear... I didn't know how to respond to this without being rude.

Show me anywhere in the world laissez faire is operating Bernard? And don't go saying Somalia.

Isn't that the point? It's not operating anywhere, because it's nonsense.

and why not somalia? its the closest real result to a not working libertarianism we can see.

regards

After reading Fran O'Sullivan's piece there was an audible pop in me britches , and I realised that me Gummy brain had just exploded ...... how could such a sensible journalist suddenly take complete leave of her senses and write this utter rubbish ?

..... her cure for a problem created by altogether too much bureaucracy , and patently incompetent bureaucracy at that ....... is more bureaucracy ! .. Saints preserve us from these " big government knows best " plonkers .

Gummy wonders how the Christchurch re-build would be progressing if property owners were allowed to re-design & re-create their own structures , with assistence of their personal choice of engineers , architects , and builders .

... the idea of comandeering private citizens' land belongs in Stalin's USSR , Fran ....... not in New Zealand , 2011 . ...... so does the concept of continuously fleecing those citizens who have worked hard , and become more successful than the average Svetlana & Vladimar , comrade O'Sullivan .

If they had given us the money and let us get on with it we'd be up and running again by now

Here's another thought to ponder : Canberra !....... if anyone doubts that bureaucrats will screw up Christchurch , send those doubters to Australia's capital city , to witness first hand a soulless city , devoid of character . Canberra is a modern construct , a city planned out and built for a massive bureaucracy , the Australian government .

....... do we believe that Bob Parker , the CCC , Jerry Brownlee & Roger Sutton will do any better in the reconstruction of our garden city ?

I'd trust the thousands of Christchurch city property owners , re-building independently of each other , and re-building without the bureaucratic machine breathing down their necks , to create a more pleasing and atmospheric central city .

Now you are talking Gummy! Always a bereaucrats there to get in the way. The more you regulate it the worse it will be, it is an established pattern.

Downside is it will take a couple of hundred years to get back what we have lost, as it will take that long for people to learn the design language that was once common.

maybe because she has finally twiged that she and most of teh rest of us are being screwed over.

maybe because she can see we are staring down the terrible slope to the greatest depression isnce teh 1870s....or even ever....

All caused by the neo-classic, voodoo economic disaster of the last 30 years.

regards

Bernard, you said,

"Let's face it. Free trade works best for mercantilists. We have to acknowledge the world is not free and fair.

It seems cynical and sad, but in the end you have to fight for your national interest and avoid the sort of social disruption we're now seeing."

I can't make sense of this. a) Mercantilists are opposed to free trade. b) Mercantilists, free-traders and every other economic theorist all claim that they are fighting for their national interest. They just have different ideas on what needs to be fought for in order to benefit the nation.

In addition you say free trade has caused the loss of jobs, concentration of wealth, indebtedness etc. How did you make these connections? Please explain.

Free trade and globalization has lifted tens of millions out of poverty created one of greatest economic booms in the worlds history provided the world with cheap consumer items and massive new wealth.

I dub thy pronouncements dogma / propaganda / fantasy

Now, if only there was meaningful studies of parallel universes where free trade Vs protectionism had been experiemented with then your pronoucement re globalization could be validated or invalidated. As could mine about your pronouncement being dogma.

I would like to see the empirical evidence that sustains your claim.

Have you not noticed China, India,Indonensia, Vietnam, …………………………………………the fact you house is full of cheap fantastic appliances…………………..History show clearly that trade is the greatest generator of prosperity

Evidence please.

Repetition of a belief doesn't make it a fact

...and how much on bombs and other nasties for countries getting in the way of cheap oil?

No not really at all . If you take China as a case, you could argue that what is lifting them out of poverty (well some of them anyway) is that the governemt allowed the peasants to own and sell some of their own crops. That was it really everything else came from there. The trade with the west is kind of a side show in a way. Most of the returns from the wage and regulatory arbitrage conducted by corporations over the past twenty years in relation to China have flowed to a very small number of Chinese and to an even small number of people in the west.

The Interviews on you Tube with James Goldsmith covers this really well. And he worked it all out before it actually happened.

www.youtube.com/watch?v=4PQrz8F0dBI

Great link thank you. Gee he is pretty intense!

Bernard it is well worth it and would make the basis for a good feature article.

Your comments on ownership I have come across before and I have read (in regard to Architecture) that land ownership is a fundamental for a healthy, well performing economy(read society). It is where socialism falls down, which is unfortunately the downside of Maori culture we should avoid like the plague.

The trouble we face is that we don't truly own our land, most of it is indebted. So we have a false economy if you like.

I agree, good link. I watched the first two, somehow seemed like 'Groundhog Day' or something. I've certainly heard many of the counters to his arguements spouted by NZ polys and offcials.

????

[ .. hope you get " comment of the day " , Colin .... I am as confused as you are .. ]

" Immediately impose a special tax aimed at higher income earners to start replenishing the Natural Disaster Fund which has been exhausted by the impact of the Christchurch quakes."

This would be a perfect opportunity to test out elements of the comprehensive capital tax (CCT) as suggested by Gareth Morgan.

A one off capital tax could be a fair solution to pay for the rebuilding of Christchurch.

..... or we could just needle the insurance companys to pay out what they owe to owners of damaged properties , and get the CCC to do a large bond issue .....

Allow private property owners to select their own private engineers , architects & construction firms .......

.. and forget about introducing a new tax ...... hmmm ?

Interesting fellow on Bloomberg TV yesterday , Marshall Mays , an eccentric American who resides in HK , and runs an emerging markets fund .

... he is not a fan of Fonterra ! .. and has moves afoot to invest $US 20 million annually into Asian dairy enterprises , particularly the Philippines . He claims that the RP has a spare 2 million acres of de-forested land , ripe for dairy & beef production .

They project that within ten years they'll be responsible for creating 500 000 jobs within Asia . Why support jobs in rich countries , he says ....... guess that was a swipe at New Zealand !

.. scornful of Obama , he points out that his firm can create more jobs than the government of the USA can , and at a miniscule fraction of the cost .

Oh but what about the trickle down effect Gummy? Surely we should be creating those 500,000 jobs in New Zealand, then we can all spend our money on buying cheap junk made in the RP thereby boosting their economy also.

I am liking the sound of Mr Mays:)

I shall send to you a job-lot of Philippine bamboo buckets , with my compliments ...

... they don't hold alot of water , but are supremely environmentally friendly and sustainable ......

Cheers !

Great I have the perfect use for them, I will need 120.....

I will take a drive down the Wellington when our masters are in session. One for each and when worn over the head will improve the look and sound of all of them.

Total aside..... whereabouts in the Philippines are you Mr Bear... My geography is poor due to cultural upbringing, but can read a map......program an exocet.

We're 37 km south of ILOILO city ( pop'n 400 000 , same as me old Christchurch ! ) , on a beach , Panay Bay ( Visayas region ) .

...... had the internet knocked out for a few days , typhoons do that .

All good with you KWJ .? ... saw your comment last night , merci !

Ta (googled it) - makes you realise the options out there, and how precarious/artificial the 'Western' lifestyle actually is... seem to have over-cooked it somewhat. Never saw the point of a boat..... can now though. Can I land the copter on the back, or is it to be a beach landing...

I agree with Simon Black ( Sovereign Man ) that the world's economy is unbalanced , and in incompetent hands . He chose Chile as his safe haven , incase it does all go terribly pear-shaped , and we sink into the mother of all depressions .

...... as Mrs Gummy is from here in the Phils , we've snaffled a few cheap properties , including two beach frontages , 3 farm lots , and a house in town ...... all for less than the cost of a single house in NZ .

We're off to Australia eventually ..... and the properties here will remain our " insurance policy " against a financial armageddon . Gummy has been busy planting mangos , coconuts and other useful fruit bearing tree seedlings ... gotta get a few hundred mahogany seedlings for the higher ground ( they grow as quick as radiata pine does in NZ ! ) . We have a native stand of teak trees on one block .. frigging amazing .

We''ve got a rimu (more than most I guess)...just need to give it another 575 years.... looks like that teak is a rarity....keep the saw clear.....Norway/GMO might be interested....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.