The see-saw that drives the Global Dairy Trade action has definitely continued being stuck in the mud and if anything has gone in a bit deeper at this latest sale. With the weighted average down -4.6% on the previous sale.

- Butter index down 2.6%, average price US$4,851/MT

- Ched index down 3.9%, average price US$4,769/MT

- SMP index down 6.9%, average price US$3,250/MT

- WMP index down 4.4%, average price US$3,421/MT

After hitting record highs earlier this year the price is now the lowest since January 2021. Given that consumer prices for many if not most foods are reaching record highs the downward trend is bucking what is happening locally.

Much of the reversal of the dairy prices appears to be due China still struggling to break out of its self-imposed covid shackles. Due to the current attitude being reinforced at China’s Communist Party Congress this week it appears that the reduced demand may continue for some time yet. Westpac has come out acknowledging that there are “now downside risks to our milk price forecast of $9.25/kg”. It’s too early yet for dairy farmers to lose sleep however if the trend continues beyond Christmas we can expect Fonterra to start chipping away at their forecasts.

The only bright light is the ongoing commentary that has world milk production down which should eventually lead to a price recovery.

Domestically we had the release of the inflation rate for this year’s 3rd quarter being at 2.2%. It appeared to surprise some economic commentators. They obviously haven’t been the ones doing the grocery shopping.

For most people they have been seeing prices going up on an almost weekly basis.

Most suppliers to supermarkets and other retailers have tried to contain price increases and pass them on as a last resort. Given the low rate of inflation prior to this year persisting for some time many have been out of practice of doing regular adjustments. Unfortunately, not so now. So, a lag in price increases which had appeared in some products is now in catch-up mode. A snippet from a notification from our egg supplier is likely to be reflected around the country.

“We’ve worked hard to maintain constant prices however we continue to experience several cost increases from our suppliers which are now beyond our control.

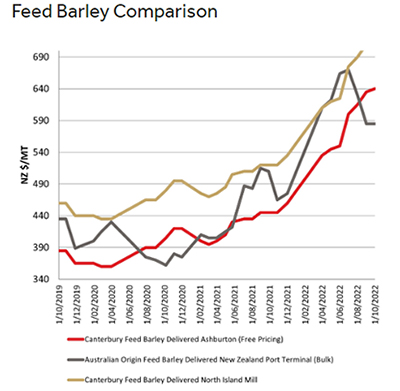

• The biggest input for our operation is feed for our hens. Feed costs from our supplier continues to increase another 10% increase in addition to the 32% increase experienced earlier this year. The cost of raw materials and proteins for feed continue to rise globally. We have been notified by our feed supplier that we can expect another review in the first quarter of 2023.

• Moulded fibre packaging increased 19%, due to the cost of raw materials, electricity, gas, and freight increasing.

From the 1 November 2022 we will be implementing a 23% increase per tray for all grade sizes and dozens cartons”.

The costs these folk have carried will also be being incurred by pig farmers. It will also be being felt overseas where much (most) of our pork comes from so bacon lovers cannot expect too much reprieve from imported goods. If the prices haven’t gone up dramatically yet it can only be a matter of time. Bacon and eggs may become a discretionary expense at this rate.

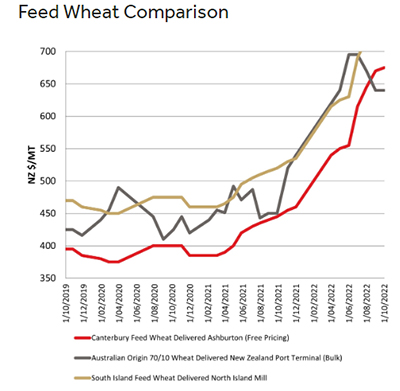

I was also talking to a grain rep who said despite the high prices being paid they have farmers nervous about sowing crops due to the high costs incurred from diesel and fertiliser among other things and not knowing yet what prices will be like at harvest. 2023 contracts for wheat and barley appear to be in the $555 -$565 and $535 -$540 range respectively although I have heard of figures around $700 plus being paid for grain recently.

Given the high costs to grow it is probably at this level where it needs to be to provide farmers with some security when sowing. It may be that grains will be in short supply come next harvest due to reduced area compounded by, if the Australian experience is repeated, lower yields due to reduced inputs (i.e. fertiliser).

Sorce: Ruralco. Grain report.

The uncertainty that grew out of the pandemic appears to have some distance to run yet and there appear to be more downsides than up at the moment.

39 Comments

Read somewhere that agricultural inputs were leading the charge with regards to inflation so it’s no surprise it needs to wash through - the surprise will be in how supply (constrained due to lowering inputs) meet demands (also constrained due to high cost to purchase) - recipe for an all fire economic train wreck which could be of a scale not seen since the Great Depression. If buyers can’t buy and sellers can’t sell at a profit then an enormous amount of value needs to be lost out of the system in order to let the value re-adjust to where the new (poorer) economy can regain balance.

freaky 😳😳

It's only labelled the way it is "made in NZ from local and imported ingredients" so they could avoid saying it's imported pork. The go-to excuse was that they couldn't accurately say what and how much of each ingredient was from where. Sounds unbelievable - or maybe they're shockingly bad at process manufacturing.

I believe IMO this is a result of the banning of Sow crates years back, many farmers pivoted from pork due to the large increase in costs of production, and then the importation from Spain at the time increased, now from wherever. We demand better animal practices, then simply buy from countries that don't have the same legislation so that we can keep the product at a price consumers will pay.

So in May I put 10 tonne of fert on the easy country. $500/tonne give or take. In September a similar amount, $800/tonne. If you goobers out there think there is any room to pay for methane or co2 emissions your dreamin mate.

So next up is the real deal, the main course so to speak. I am dabbling with heading back to dicalcic, cheap...bit of lime in there, adding a dash of sulphur and bugger the potassium. However most other farmers I know are just putting lime on. So just watch production tank. Mine will with what I am doing. But only lime?

It might take another year depending on your soil types and fert history. But it will happen. Food inflation isnt just here, its going to get a lot worse.

Forgive me for being a little skeptical but I think that at least some inflation-blamed cost increases are simply a self-fulfilling convenience initiated because of the times we are in rather than the real need for a business to stay solvent. They may be a case of "everyone is raising their prices so why shouldn't we?". For example, with respect to the egg supplier quote Guy refers to, I honestly fail to see that actual unit price increases in overheads such as electricity, labour, transport, etc. have occurred to the level of the 23% quoted. Anyway, if businesses are really hurting that much, then why does Orr actually need to increase the OCR to dampen spending.

The RBNZ is now in a cycle of increasing the OCR each and every review, but to continue to do so can surely only add to inflation, not restrict it. Just stop doing it Adrian. Afterall, the housing market is contracting at last so why increase the OCR for this particular factor and surely our dollar has now reached a point where exporters should be a whole lot more competitive irrespective of cost pressures. Further drops in the value of the NZD can now only add to imports driven inflation.

The RBNZ should see that the old economic rules just don't apply now. Increasing the OCR used to see a commensurate rise in the value of the NZD but that certainly hasn't happened this time round.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.