Kiwibank economists say the absence of a migration-led boost to consumption in NZ points to a "weaker inflation impulse" than might have been expected from a fast-growing population.

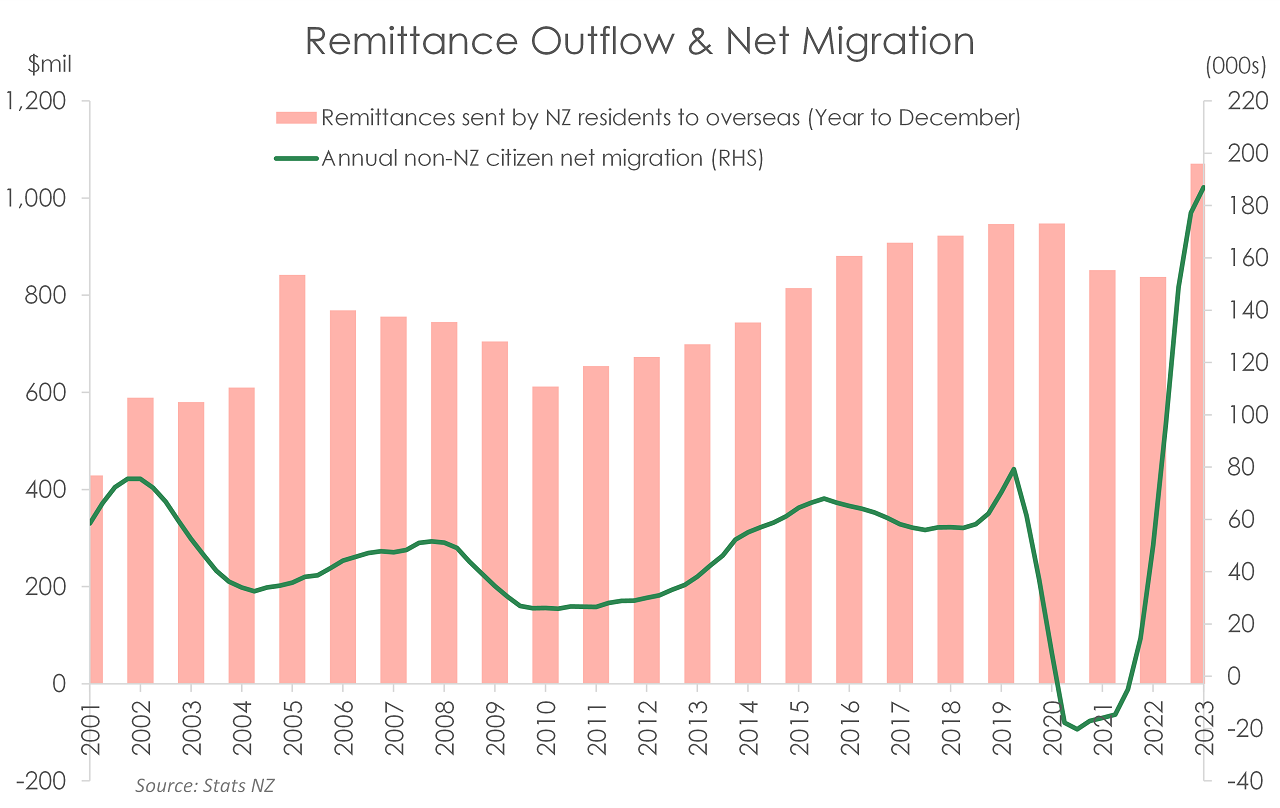

In their latest First View publication, Kiwibank chief economist Jarrod Kerr, senior economist Mary Jo Vergara and economist Sabrina Delgado, point to the fact that in 2023 the annual money remittance outflow exceed $1 billion for the first time.

According to the most recent Statistics NZ migration figures, the country had a net migration gain in the 2023 calendar year of over 139,000 people while inbound migrants totalled just over 250,000. This has led to a lot of talk and conjecture about what the ramifications may be for inflation - as more people vying for products and services could obviously potentially put upward pressure on prices.

But the Kiwibank economists are countering that view.

"Net migration surged in 2023. And more people means more demand. But migrants are arriving at a time when the economic undercurrents are softening," the economists say.

"High inflation and high interest rates dominate the environment. So, despite rapid population growth, retail trade has been softer than one might expect," they say.

Alongside tighter financial conditions, the rise in remittance outflows may also explain why consumption has underperformed, they say.

"The amount of remittances sent by NZ residents to overseas dropped 10% below pre-covid levels in 2021, but sharply recovered in 2023.

"Annual remittance outflows exceeded $1 billion for the first time in 2023.

"Undoubtedly, inflation is working behind the scenes. But the all-time high also coincides with the 2023 migration boom, specifically the strong migrant inflows from India.

"India has long-been the top recipient of global remittances. According to the World Bank, India accounted for 14.5% of global remittances in 2023.

"China and the Philippines are also among the top five. And it is migrants from these countries that make up the bulk of arrivals into Aotearoa."

The Kiwibank economists say that as migrants send some portion of their wages back to their home countries, it suggests weaker local consumption than otherwise.

"The absence of a migration-led boost to consumption points to a weaker inflation impulse than one might have expected from a fast-growing population."

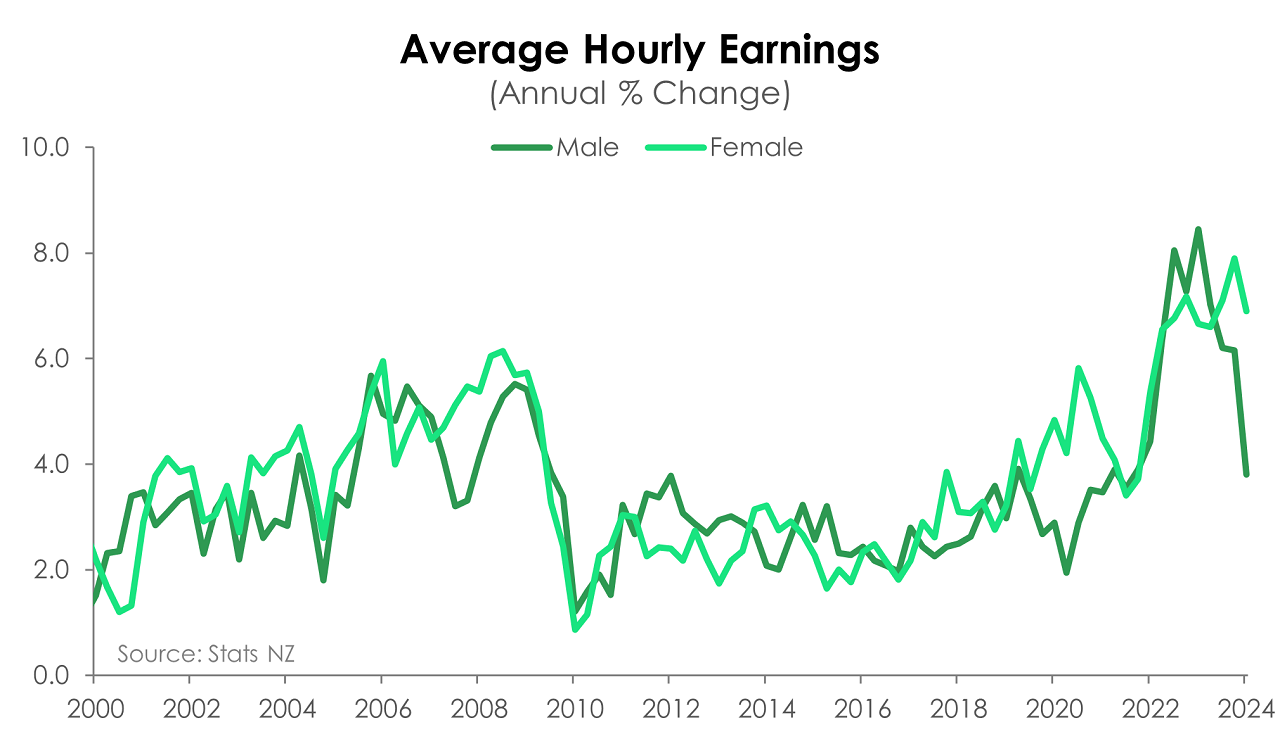

Separately, the economists noted that a highlight of last weeks Stats NZ labour market report was seeing the way women’s wages have performed over the past 10 years.

"Average hourly earnings among women doubled in the last decade, up $12.91, while men experienced a 43% increase. It likely follows the wider dispersion of women within the labour market, branching out of low-paid occupations traditionally held by women.

"In saying that, nearly a third of all jobs held by women are in health care and education industries," they say.

They say the 7% rise in women's hourly earnings in the year to March was largely driven by the pay increases within these two industries. In the same period of time, men’s wages grew 3.8%, down from 6.2%.

"A slowing construction industry, of which men make up about 85% of the workforce, likely saw slowing wage growth. For now, discrepancies between the level of wages between men and women remain, but it’s encouraging to see an acceleration in women’s wage growth."

41 Comments

Excessive migration was designed to undercut the local labour market and push down wages. That's what all the "labour shortage" propaganda was about. In future, remember, there's no such thing as a labour shortage, only employers that don't want to meet the market.

Now on top of flat lining wages and employment, we've got the added issue of reduced demand because of the disappearance of the mulitiplier effect due to money that was formerly circulating here being sent offshore. There's very little economic sense behind it, just greedy special interests trying to keep working folks down, and exploiting workers.

100%. There will be some exceptions in truly skilled jobs (e.g. we can probably import a neurosurgeon faster than we can train one, at the extreme end) but outside of that there is no labour shortage - just a shortage of "labour as cheap as we'd like it".

To my mind caving to the business lobby on this will remain Labour's most egregious sin.

So many workers imported under the health umbrella are just unskilled or poorly suited people who will be getting low rock bottom wages as carers and support workers e.g. retirement home staff. Most will need no qualifications for the roles, but NZ health employers will import rather then employ kiwis for these roles and they & the Govt never will increase carer and support worker wages (Labour killed the pay equity win for them with a 6 year delay with the matter to be closed for good at the time of the election). Yet we classify hospitality workers pushing a vacuum or making coffee and retirement workers as essential skills. Right at the time most the overseas staff were hired unskilled into the roles anyway, yet we penalize NZ workers by requiring them to do multi year long courses for the roles.

Why migrants are a benefit is they are closer to being itinerant workers who don't need to pay housing and rent costs for a family and can reduce the cost of living by living 3-4 to a room. Many cannot even afford hostels in many cities hence even with low paid migrants there is not enough of them able to fill the workforce gaps and because it is health (you can argue it is nursing roles) it is essential medical needs roles or "specialist" ones but hands tied the govt does not want equitable wages and so the employers will plug the gap as best they can.

Even for a part time job in this sector over 100 overseas applications are received with none with any suitable experience or truthful backgrounds, all for a health job under the living wage, not funded by govt even for a minimum wage. In reality it is just residency hopes and the turnover of these roles is extremely high with staff leaving in a short time after they get into the country for other better paying roles.

Hospitality is another sector that screws the local workforce so much that they can no longer live on the peanuts given and even migrants find it difficult to afford a roof over their heads in a cheap camping ground with the low pay.

The housing market has skewed so much that even rent is difficult and most jobs being imported cannot fund it.

You're right of course. Our economy is completely out of balance. We have too many jobs that do not pay anywhere enough for the employee to afford basic accommodation, food, and any kind of quality of life. Our response to this growing problem has been to increase in-work benefits - and this has required us to to increase taxes to support that redistribution, and around and around we go.

We need to reset the economy. Anyone working full-time after a couple of years of training or education should be able to afford to live a decent life on the money they earn without a Govt top-up. It's about time a politician stood up and said that.

That would be on my "day one" list of priorities if I were running the show.

An egregious program that - let's face it - was set up to win some votes, which is now all-but-impossible to roll back because employers have got used to being able to have the taxpayer pick up the slack.

Your comment yet we penalize NZ workers by requiring them to do multi year long courses for the roles." - exactly - we used to have a good work and learn on the job apprenticeship system killed off in the 80s (?) by lazy employers and education think tank bureaucrats who said everyone should go to polytech/uni. Now we import "skilled" people who have learnt their skills how exactly? Its rubbish and we have stifled a minimum of 2 generations of young NZers who simply wanted to leave school and be a mechanic/plumber/nurse etc etc

Current account deficit is over 6% of GDP (in part because of those remittances)

Net Govt spending is running at under 3% of GDP

Net bank lending is 3% of GDP (as low as it was in 1991 and 2008)

Hence, overall position = Negative

So, until one of the above variables change substantively, the recession will continue. Or maybe savers will suddenly decide to withdraw all their term deposits and go on a spending spree (seems unlikely)?!?

Fair! We have about $24bn of current account deficit, $1bn of which appears to be remittances (4%?) I am guessing there must be some flowing the other way too (kiwis working in Aus)?

Key point I was making is that our current account deficit transfers ownership of NZ dollars (and then NZ Govt Bonds) offshore. We now have $80bn of Govt bonds offshore - creating a flow of around $2bn a year in Govt interest payments offshore.

It makes a mockery of the theory that migrants on the whole always buy our houses en-mass and pump the price. Yes - sure, rents have been pumped yet despite this, renting remains cheaper than owning! Not only are our houses still too expensive for migrants, they're more vested in sending their earnings elsewhere to be spent elsewhere where it creates jobs - elsewhere.

Migrants sending remittances usually do so to support family members' living expenses back home. This is of course a matter we should consider when setting immigration policy (i.e., the ability of migrants to sponsor family members to migrate to NZ).

There are many cultures where generations of family living together is the norm, and so 'on-shoring' that ability for children to sponsor their parents to NZ might be a net benefit to NZ. I'm not sure what our current immigration settings are in this regard.

Migrants sending remittances usually do so to support family members' living expenses back home. This is of course a matter we should consider when setting immigration policy (i.e., the ability of migrants to sponsor family members to migrate to NZ).

Kafkaesque. The ruling elite and bureaucrats across the Anglosphere see increased migration as the low hanging fruit of economic growth.

They just don't really think it through properly.

Why on earth would we want even more elderly people here to clog up our already overburdened health, superannuation, and aged care sectors? Australian studies on immigration have estimated the taxpayer cost of the Parents Visa at more than $400k per person (and that study was done about 10 years ago so can probably double that now). There is no way that a migrant pays enough tax to cover that cost, and it defeats the reason they are here to work in the first place, which is so their taxes can pay for our parents health, pension and aged care costs, not theirs.

The better approach is to provide temporary work visas, and when the migrant needs to take care of their elderly parents, they return home to do so. And we replace them with new, younger migrants. The amount of money that migrants send home should be a factor in considering whether or not to extend their visa, or give them residency. Send too much home, send them home.

Was reading about how the education industry in Aussie has become little more than the selling of visas with ticket clipping everywhere. And we're not talking only about Bob's English School. Sydney University's foreign enrolment is at all-time highs.

The Universities are not providing additional accommodation for foreign students, thereby putting pressure on private rental stock. Yet, the Vice Chancellors still collect their million dollar salaries.

CEO of an education consulting company in Aussie was the nation's highest-paid chief executive in the 2019 financial year -- taking away $38 million.

It's a rort.

https://www.abc.net.au/news/2020-08-07/idp-education-ceo-andrew-barkla-…

Why on earth would we want even more elderly people here to clog up our already overburdened health, superannuation, and aged care sectors?

All these concerns can be addressed. for example, no ability to qualify for super if entering NZ on a parents visa; requirement for children to secure private health insurance of a specific type; no ability to qualify for government-assisted aged health care.

All these concerns are able to be addressed through thoughtful regulation such that their living in NZ becomes a net benefit. If we want to attract and retain well paid professionals, family unification is a very important consideration for many overseas professionals seeking employment overseas (somewhere other than the country of their birth).

Just a guess, but probably the shares that return the best dividends (regardless of domicile) are the best for NZ - as you'll then spend the earnings into the NZ economy.

Here's my logic: I used to enjoy a tipple with the TAB. I took out an account with them because you got a free Sky dish installation for opening an online betting account. As I had to make a minimum deposit (I think it was $20.00) so I started betting that away in one dollar increments. Pretty soon I had about $30.00 - so I got a bit more 'bold'. Tried out the low probability/higher earning bets - and my oh my, I won a packet on a trifecta. Immediately withdrew it and deposited the winnings in the bank.

I'm guessing you're a similarly conservative investor :-).

Was in a sportsbar over a decade ago...some guy walks up and asks if I can place a $20 win bet for him on the horses (Ozzie Gallops)...I said 'No' mate ,make your own bets...he went and made the bet...it won...He comes back and asks me again ...again I said 'No'...he makes another $20 win bet and it wins... He comes and tells me if I can make another bet ...Again I said 'No' ...again the horse wins...Happened for 6 races in a row and he nailed all of them...he must of won over $800 from those 6 $20 bets...I wandered off into the night and left him too it... I suspect there are some that know when to hold em and know when to fold em...at the TAB...lol

One of my best mates and ex-colleagues just told me they're upping sticks and relocating to Oz. The whole family - first generation Indian immigrants. That's two $200k plus p.a. ICT experts gone (and their semi-retired mum who was teaching remedial English). One more rental house back in the rental pool. (They were never sucked into NZ Ponzi. Both are far too smart for that.) How many millions will go with them? Upwards of 20 I'd have thought. Could be double that. I'm going to miss them. So will NZ Inc. and the IRD.

We relocated at the start of the year, and every time I went to get something set up (drivers licence, Medicare, bank account, health insurance, etc.) the Australian helping me get sorted commented that they are seeing so many people coming from new Zealand, they're astounded.

I've heard that a lot, but in my experience that isn't the case. Here in Melbourne, I'm in a suburb about 30 minutes by train from the CBD. We're renting for $500 pw, in a brilliant, Leafy area that i would compare to middle class suburbs on Aucklands north shore. Equivalent probably $850 pw on the shore? You can pick up a 3 bedroom starter home here for $700k - $800k, and they are all on massive sections. You'd be hard pressed to get a 2 bed townhouse on a postage stamp for less than $1.1m on the shore with a 30m commute to the city. People try to compare medians and averages, but Melbourne just has a much bigger range so there's more room at the bottom end.

Its not just European New Zealanders who are upset about being turned into second class citizens in this country. It affects immigrants as well. Knowing that they too are excluded from health and education services because of their race. Many immigrants moved from their home countries to get away from such ethnic based systems.

Lived in Melbourne for 13 years. The weather was fine. Its seasonal - and you learn to wear layered clothing, because those seasons all occur on the same day (insert Crowded House song lyric here). Winter was great - used to go for tea pots of hot buttered rum cocktails on the roof top terrace at Madame Brussels, wrapped up in complimentary woolly blankets, sitting under the stars under the heat lamps.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.